Global merchandise trade and shipping are entering a phase that looks deceptively calm on the surface but is structurally far more complex beneath. Shipping volumes remain below their long-term trend, not because globalisation has ended, but because it is being re-engineered. After the post-pandemic surge and subsequent correction, firms are no longer chasing volume growth; they are recalibrating risk, inventory, and capital exposure in a world where disruption has become systemic rather than exceptional.

Historically, shipping cycles were driven by demand, fuel prices, and capacity. Today, the cycle is increasingly shaped by geopolitics, insurance markets, regulatory risk, and strategic stock management. Inventory corrections across advanced economies reflect not just slowing consumption, but a deliberate move away from just-in-time models toward just-in-case buffers. This structural shift dampens shipping volumes even when nominal trade values appear resilient, especially as inflation and higher-value goods mask physical throughput weakness.

Freight Rates: Stability That Masks Fragility

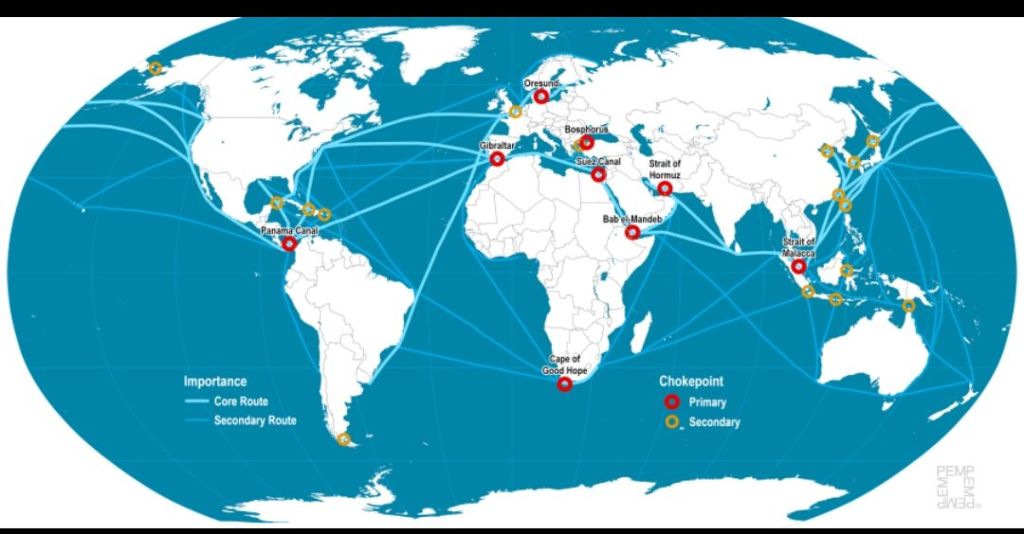

Freight rates currently appear stable, but this stability is fragile and conditional. Unlike earlier decades where rates were primarily a function of fleet size and fuel costs, today’s pricing embeds geopolitical risk premiums. Sensitive sea routes—whether chokepoints or politically contested corridors—now carry implicit insurance and security costs that can spike suddenly. The result is a freight market that is calm until it is not, with sharp discontinuities rather than smooth cycles.

From a historical lens, this marks a departure from the global shipping order that prevailed from the 1990s to the mid-2010s, when efficiency gains steadily lowered costs and expanded trade elasticity. In contrast, the current era resembles earlier periods of fragmented trade routes, where political risk and maritime security materially shaped commercial decisions. The difference is scale: modern supply chains are vastly more interconnected, making even localized disruptions globally transmissible.

Logistics Strategy: From Cost Minimisation to Resilience Engineering

Logistics firms increasingly report demand not for cheaper routes, but for diversified ones. Route redundancy, multi-port strategies, and alternative corridors are becoming core commercial offerings rather than contingency plans. This reflects a broader strategic shift: logistics is no longer a back-end efficiency function but a front-line risk management capability.

For manufacturers and traders, this means accepting structurally higher logistics costs in exchange for reliability and predictability. Historically, trade growth was enabled by declining logistics costs; futuristically, trade continuity will be enabled by resilient logistics architectures. This transition mirrors the evolution seen in energy markets, where security of supply has overtaken price as the dominant concern.

The Futuristic Outlook: Slower Trade, Higher Strategic Value

Looking ahead, global shipping is unlikely to return to the high-volume, low-risk expansion model of the pre-pandemic era. Instead, merchandise trade will grow more slowly in physical terms but carry higher strategic and political weight. Shipping lanes will increasingly resemble strategic infrastructure rather than neutral commercial highways, and logistics firms will function as geopolitical intermediaries as much as transport providers.

The critical implication is that trade resilience will become a competitive differentiator. Countries, firms, and ports that can offer secure, diversified, and well-insured routes will attract trade flows even in a subdued global demand environment. In this sense, the future of shipping is not about moving more goods faster, but about moving essential goods safely, predictably, and under conditions of permanent uncertainty.

The global economy is not de-globalising; it is re-pricing risk. Shipping is where that repricing is most visibly—and most consequentially—underway.

#GlobalTrade

#ShippingResilience

#SupplyChainReconfiguration

#FreightRisk

#GeopoliticalDisruption

#LogisticsTransformation

#RouteDiversification

#InventoryCorrection

#MaritimeInsurance

#TradeUncertainty

Leave a comment