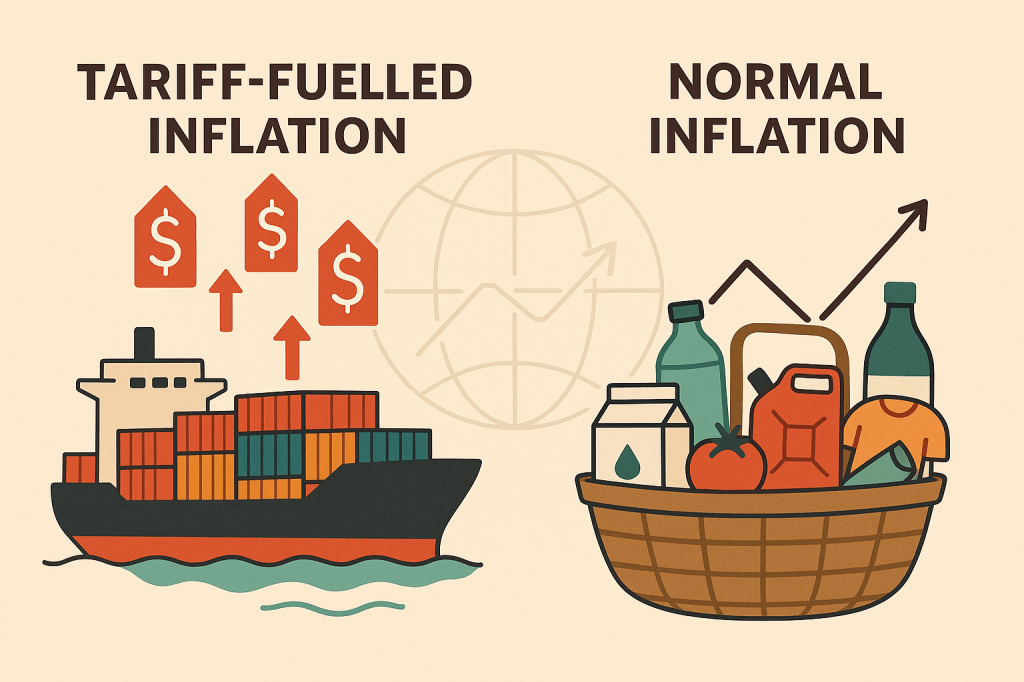

Inflation is not new to economic history. From ancient Rome’s currency debasement to the oil shocks of the 1970s, rising prices have repeatedly altered the trajectory of societies and markets. Yet the 2020s and 2030s have brought back a somewhat forgotten variant of inflation—tariff-fuelled inflation—a policy-driven price rise that reflects the new age of geopolitical rivalry, trade protectionism, and fragmented global supply chains. To understand this phenomenon, it is important to contrast it with normal inflation, the broad-based price increase that most countries experience as part of regular economic cycles.

Tariff-fuelled inflation emerges directly from government decisions to impose duties or taxes on imported goods. When a country raises tariffs—whether to protect domestic industries, retaliate against foreign governments, or realign global supply chains—the immediate effect is an increase in the landed cost of imported products. Businesses that depend on imported inputs face higher production costs, and these costs quickly pass through to consumers. This form of inflation therefore falls squarely within the category of cost-push inflation, where the inflationary pressure arises from rising input prices rather than from excess demand.

A classic example is the series of tariffs implemented during the U.S.–China trade war beginning in 2018. While presented as a geopolitical strategy, the tariffs raised prices on a wide range of goods, from electronics to everyday household items. Even when general inflation remained moderate, tariffed goods exhibited higher and more volatile price behaviour. Central banks could do little to offset such inflation because reducing interest rates cannot compensate for government-imposed cost pressures. In this sense, tariff-fuelled inflation is an external shock created by policy choices rather than economic fundamentals.

Normal inflation, by comparison, is a much broader macroeconomic phenomenon. It reflects sustained increases in the prices of a wide basket of goods and services, arising from multiple forces: rising consumer demand, expanding money supply, higher production costs (such as wages or energy), or shifts in supply and demand across markets. Measured through indices like the Consumer Price Index (CPI), normal inflation reflects the economy’s overall loss of purchasing power over time. Historically, periods such as the post-World War II boom or India’s liberalisation years of the 1990s saw normal inflation driven by rising demand and rapid economic expansion.

The distinction between these two forms of inflation becomes more important in a world where geopolitical tensions and industrial policies shape economic outcomes more than pure market forces. Tariff-fuelled inflation is not broad-based; it is highly specific to the goods and supply chains affected by the tariff. However, if these goods form a critical part of manufacturing input baskets—such as semiconductors, energy components, or essential metals—their price rise can spread through the economy, mimicking broader inflation. This ripple effect is particularly concerning in interconnected economies where imported components dominate production structures, as seen in global electronics, automotive manufacturing, and pharmaceuticals.

In the long run, the consequences of tariff-driven inflation can be more complex than simple price changes. Companies may shift production to tariff-free regions, accelerating the trend toward “friend-shoring” and “near-shoring.” Consumers may face prolonged higher prices if domestic producers fail to scale up efficiently. And policymakers may misdiagnose the inflation, tightening monetary policy even when the root cause lies in trade actions rather than excess demand—thus slowing economic growth without tackling the real driver.

Normal inflation, on the other hand, often responds to standard macroeconomic tools. Central banks can adjust interest rates, governments can moderate spending, and supply-side reforms can ease price pressures. Unlike tariff-fuelled inflation, it carries a predictable rhythm that economists have studied and policymakers have managed for decades.

Looking ahead, the future of global inflation is likely to feature a hybrid of both forms. As trade blocs strengthen, supply chains regionalise, and industrial policy becomes central to national strategy, tariff-fuelled inflation may become a recurring theme rather than an exception. Meanwhile, economies transitioning toward green energy, digitalisation, and advanced manufacturing will continue to experience normal inflation driven by structural demand shifts. This intersection of traditional and policy-induced inflation will require a more sophisticated policy toolkit—one that integrates trade strategy, industrial planning, and macroeconomic management.

In essence, while normal inflation reflects the economy’s natural pulse, tariff-fuelled inflation is a symptom of the world’s new geopolitical heartbeat. Understanding the difference is crucial not just for policymakers but for businesses, investors, and consumers preparing for a future where inflation may no longer be a single story, but a multi-layered narrative shaped as much by global politics as by economics.

#TariffInflation

#NormalInflation

#CostPushPressure

#TradePolicyImpact

#GlobalSupplyChains

#PriceVolatility

#EconomicHistory

#GeopoliticalEconomics

#MonetaryPolicyLimits

#FutureOfInflation

Leave a comment