A Global Trade Reality Check

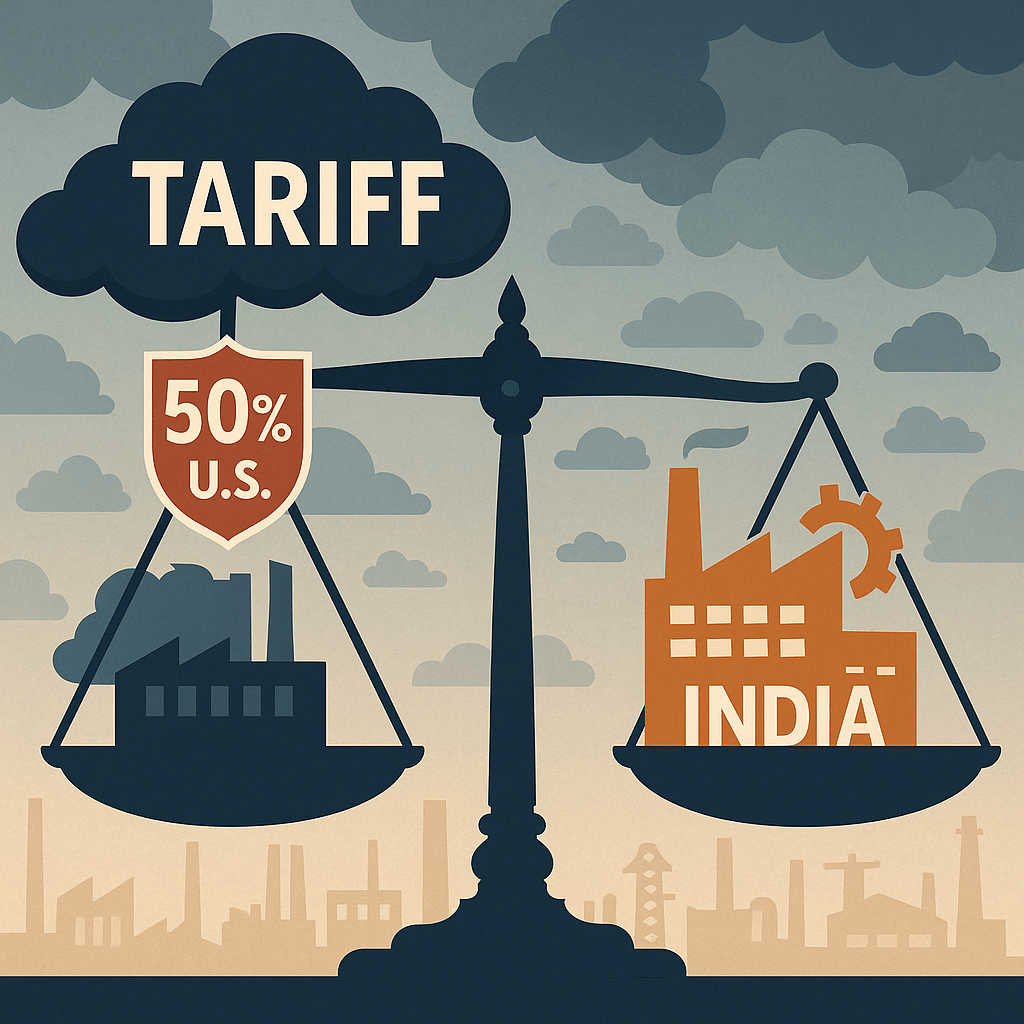

India’s ambitious plan to expand its manufacturing base — particularly in labour-intensive sectors like apparel, electronics, and auto components — faces a fresh headwind. The World Economic Forum’s analysis, cited by The Economic Times, warns that a 50 % U.S. tariff threat could significantly undermine India’s export-oriented manufacturing trajectory. This is not an isolated risk; it is a reflection of the global fragmentation of trade policy, where geopolitical motives increasingly override economic logic.

Historically, India’s industrial policy has thrived on the assumption that open global markets will absorb its low-cost exports. That assumption is now breaking down.

A Historical Perspective: From Liberalization to Protectionism

The 1991 reforms opened India’s economy to global markets, initiating three decades of outward integration. Apparel, leather, gems and jewellery, and later electronics, became engines of export-driven job creation. Between 1995 and 2015, global trade grew at almost twice the rate of global GDP — a golden era that rewarded countries aligning domestic production with export demand.

However, the post-2018 trade wars and subsequent COVID-era supply-chain realignments reversed that trend. Tariffs, reshoring, and “friend-shoring” replaced free trade with “strategic trade.” India’s current challenge lies not in competitiveness alone, but in navigating a world where politics defines market access.

Lessons from the 20th Century

High tariffs once shielded domestic industries — the U.S. Smoot-Hawley Tariff Act (1930) is a classic example — but it also deepened the Great Depression by shrinking global demand. Today’s 50 % tariff threat echoes that same protectionist impulse.

For India, such barriers could derail its “Make in India” and PLI-linked manufacturing ecosystems, particularly in segments dependent on U.S. demand. Apparel exports, for example, face thin margins and intense competition from Bangladesh and Vietnam — both beneficiaries of preferential trade access. A tariff hike could swiftly redirect supply chains away from India.

The Supply-Chain Domino Effect

A 50 % tariff does not just hurt exporters; it triggers a chain reaction:

Cost Inflation: Inputs sourced from global suppliers become costlier, reducing competitiveness.

Investment Hesitation: MNCs may pause new factory setups in India if trade access is uncertain.

Employment Impact: Labour-intensive sectors absorb millions — particularly women in apparel and electronics assembly — who risk job loss if export orders decline.

Exchange Rate Volatility: Reduced foreign exchange earnings could pressure the rupee, indirectly raising import costs.

Thus, what appears to be a U.S. policy move is, in effect, a shock to India’s employment and social stability equation.

Diversification and Resilience

India’s manufacturers can no longer rely on static duty regimes or a single export market. The way forward must integrate trade-policy resilience into business models:

Diversify Export Markets: Expand beyond the U.S. and EU toward Africa, Latin America, and ASEAN — regions where tariff barriers are lower and demand is rising.

Strengthen Regional Value Chains: India should lead in South Asian and Indo-Pacific production networks to reduce vulnerability to Western policy swings.

Domestic Market Leverage: Build internal demand through quality, brand, and affordability — converting part of export capacity into domestic consumption.

Policy Agility: India’s trade and industrial policy must align faster — combining FTA acceleration with real-time risk monitoring and targeted export insurance.

Re-Imagining Global Manufacturing

The future of manufacturing will not be defined by tariffs alone but by technological sovereignty and adaptive ecosystems. India must transition from cost-led competitiveness to capability-led leadership:

AI and Robotics in Production: To offset wage pressures and retain global cost efficiency.

Green Manufacturing and Carbon Credits: To ensure tariff-neutral access in carbon-border regimes like the EU.

Smart Trade Analytics: AI-enabled risk tracking to anticipate tariff changes, enabling exporters to pivot quickly.

By 2035, the countries that succeed will not be the cheapest producers — but the most resilient and adaptive ones.

From Risk to Reform

The 50 % U.S. tariff threat is more than a temporary policy challenge — it is a wake-up call for India’s manufacturing vision. The lesson is clear: global trade is no longer predictable, and industrial success depends on building systems that can withstand shocks, not avoid them.

If India can leverage this moment to accelerate diversification, deepen its technological base, and design risk-smart trade strategies, the tariff storm may well become a catalyst for transformation rather than a setback.-

#USIndiaTrade #ManufacturingPolicy #TariffRisk #MakeInIndia #TradeDiversification #GlobalValueChains #ResilientEconomy #ExportStrategy #IndustrialPolicy #FutureOfManufacturing

Leave a comment