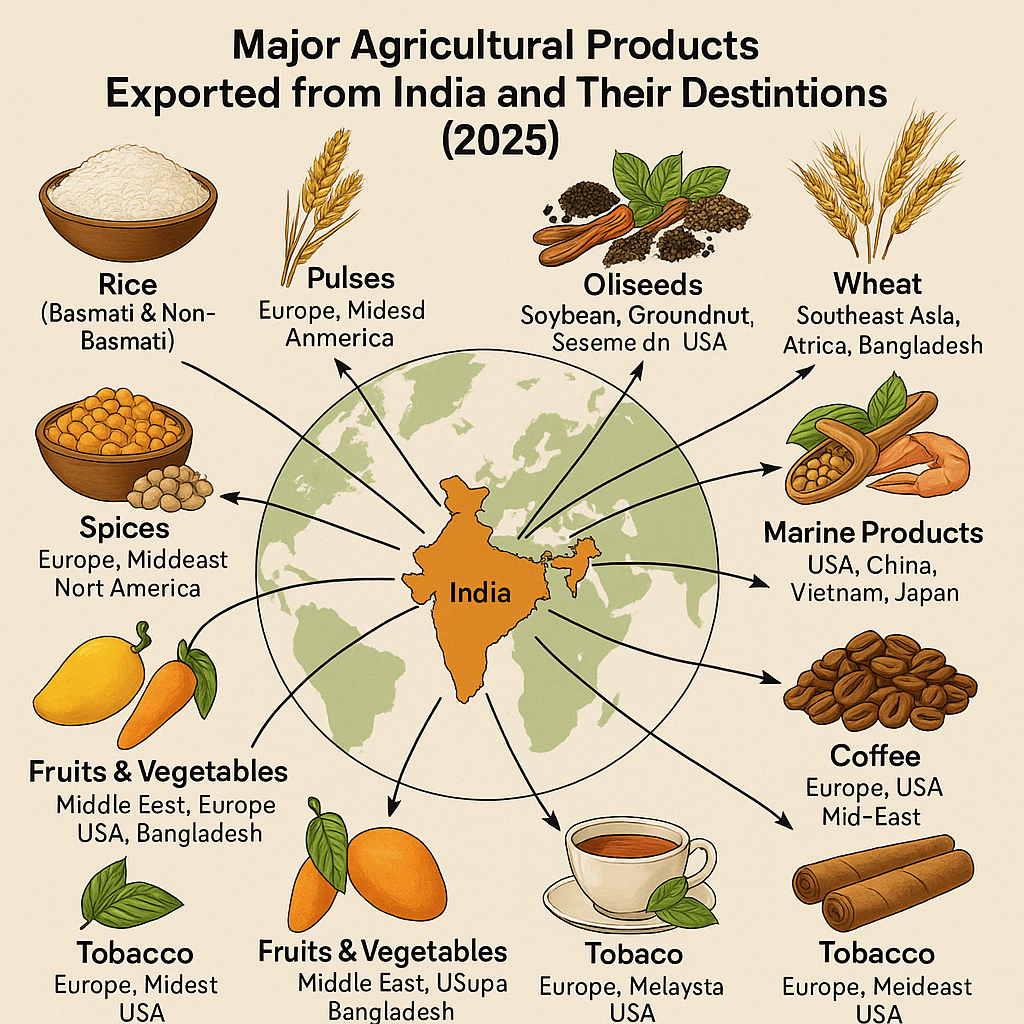

India’s agricultural export landscape continues to showcase its strength as a global agri-trade powerhouse. As of 2025, Indian agri-products are reaching an impressive array of destinations worldwide, a reflection of both India’s natural agro-climatic diversity and its expanding trade relationships. This blog presents a product-wise breakdown of major Indian agricultural exports and their top international markets,

🌾 1. Rice (Basmati & Non-Basmati)

India remains the largest exporter of rice in the world, contributing over 40% of global rice exports.

Top Destinations: UAE, Saudi Arabia, Iran, Bangladesh, China, Vietnam, USA

Critical Insight: Basmati rice is heavily preferred in the Middle East due to its aroma and length, while non-basmati varieties dominate markets in Asia and Africa due to cost competitiveness. Trade agreements with Gulf nations and regional demand spikes support continued growth.

🌿 2. Wheat

Driven by rising demand in food-deficit countries and diplomatic trade support.

Top Destinations: Bangladesh, Southeast Asia (Philippines, Indonesia), Africa (Kenya, Sudan)

Critical Insight: India leverages its buffer stocks and Food Corporation of India (FCI) procurement to ensure export capacity during global grain shortages, especially after disruptions in other wheat-producing countries.

🌰 3. Pulses (Lentils, Chickpeas, etc.)

Despite being a major importer, India also exports select pulses.

Top Destinations: Canada, USA, UAE, UK

Critical Insight: Export occurs mostly during surplus years; Indian chickpeas and pigeon peas are gaining traction in diaspora-heavy markets.

🌶️ 4. Spices (Turmeric, Cumin, Black Pepper, etc.)

India is the largest exporter of spices globally, with over 75 types of spices exported.

Top Destinations: USA, Germany, UK, UAE, Malaysia

Critical Insight: Turmeric and chili dominate exports, driven by rising global interest in health and immunity. India’s branding of spices under GI tags adds further value.

🌻 5. Oilseeds (Soybean, Groundnut, Sesame, etc.)

A growing segment aligned with global demand for plant-based nutrition and oil alternatives.

Top Destinations: China, European Union, USA, Vietnam

Critical Insight: India’s sesame seed exports have risen sharply with demand in Asia and Europe for tahini, sushi, and bakery products. Soymeal exports also benefit from rising feed demand.

🐟 6. Marine Products

Second-highest agri export category by value, especially shrimp.

Top Destinations: USA, China, Vietnam, Japan

Critical Insight: Indian seafood, particularly Vannamei shrimp, is highly demanded due to quality and traceability efforts. However, it remains vulnerable to anti-dumping duties and sanitary requirements.

🥩 7. Buffalo Meat

India remains one of the largest exporters of buffalo meat, marketed as “carabeef.”

Top Destinations: Vietnam, Malaysia, Egypt, Indonesia, Iraq

Critical Insight: Despite religious sensitivities domestically, meat exports continue due to high protein demand in Southeast Asia. Certification and hygiene compliance remain critical for market access.

☕ 8. Coffee

India is known for shade-grown, monsoon-flavored coffee.

Top Destinations: Italy, Germany, Russia, USA, Belgium

Critical Insight: European markets prefer Indian Robusta for blending. Specialty coffee exports are rising, supported by branding and organic certification.

🍵 9. Tea

India is among the top three global tea producers and exporters.

Top Destinations: Russia, Iran, UK, UAE, USA

Critical Insight: Orthodox and Darjeeling tea are premium products; recent geopolitical tensions with Russia and trade route shifts may impact demand patterns.

🥭 10. Fruits & Vegetables (Fresh & Processed)

Includes mangoes, grapes, bananas, onions, potatoes, processed pulp, and juices.

Top Destinations: UAE, UK, Netherlands, USA, Bangladesh

Critical Insight: Seasonal products like Alphonso mangoes and table grapes fetch high returns in niche markets. Export logistics—cold chains, irradiation facilities—are key enablers.

🚬 11. Tobacco (Unmanufactured & Manufactured)

India is a major exporter of tobacco leaves and chewing tobacco.

Top Destinations: Belgium, Egypt, Indonesia, UAE

Critical Insight: While facing stricter regulations, exports persist due to India’s competitive pricing and niche varieties (e.g., Flue-cured Virginia).

🌐 Top Aggregate Markets for Indian Agri-Exports in 2025

USA: High-value imports such as spices, marine products, and processed foods

UAE & Saudi Arabia: Staple foods, rice, buffalo meat, and fruits

Bangladesh & Nepal: Food grains and vegetables

China: Oilseeds and marine products

Vietnam & Malaysia: Meat, seafood, and cereals

European Union: Coffee, spices, organic pulses, and tea

📊 Strategic Takeaways

Product Diversification: India’s exports are no longer limited to traditional grains. Value-added and high-margin items like spices, marine products, and processed foods are rising.

Destination Expansion: Non-traditional markets in Africa and Southeast Asia are emerging as key buyers alongside legacy partners in the Gulf and West.

Logistics & Compliance: Investments in traceability, phytosanitary measures, cold chain infrastructure, and GI tagging are crucial for premium exports.

Trade Policy Synergy: FTA talks with the UK, UAE, and EU are critical in boosting access for Indian agri-exports, especially processed foods and perishables.

🇮🇳 Final Word

India’s agricultural export ecosystem in 2025 is marked by resilience, range, and rising sophistication. Strategic policy support, coupled with private sector innovation in processing and logistics, can propel India from being just a bulk supplier to a global quality leader in agri-exports.

#AgriExports

#IndiaTrade2025

#BasmatiRice

#GlobalMarkets

#SpicesOfIndia

#MarineProducts

#ValueAddedAgriculture

#AgriLogistics

#FTAOpportunities

#AgriEconomy

Leave a comment