Introduction

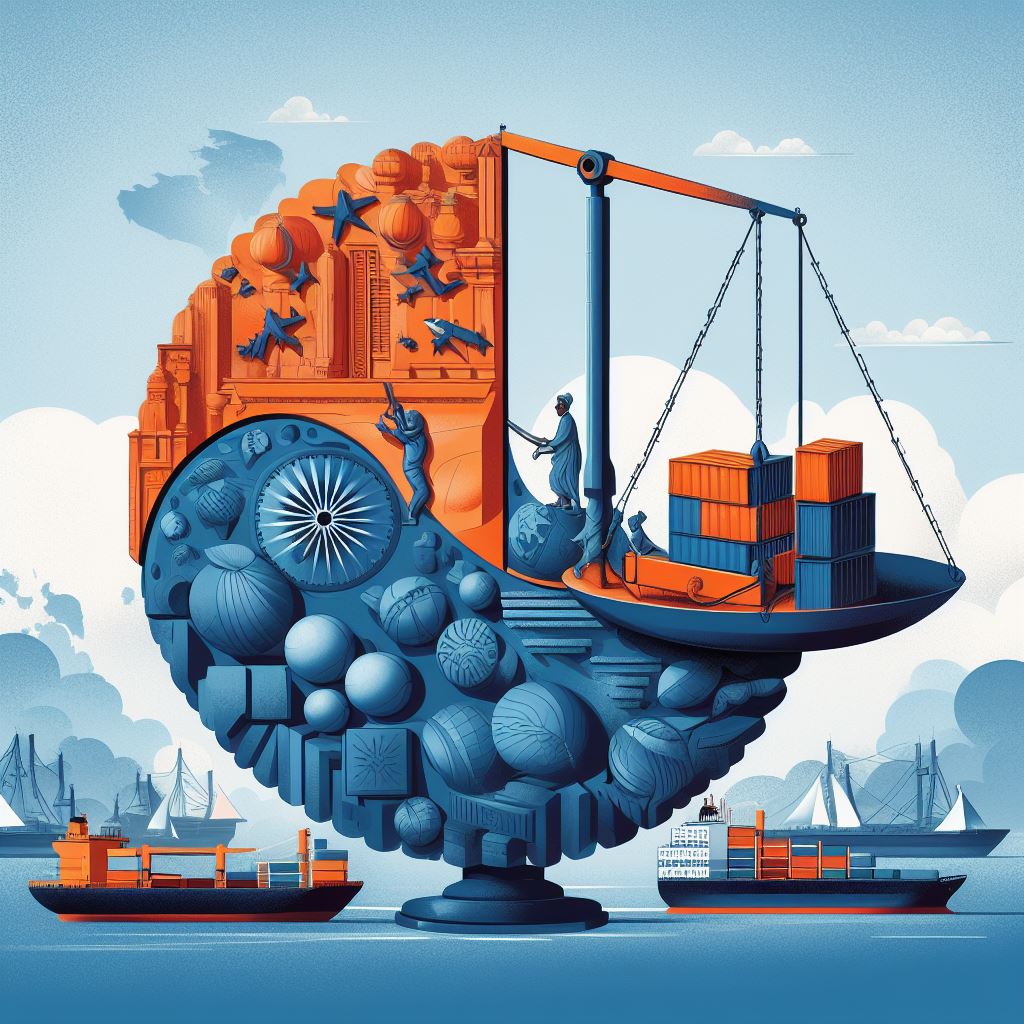

In a bid to enhance the competitiveness of its export products, the Indian government introduced the Remission of Duties or Taxes on Export Products (RODTEP) scheme in 2021. The scheme aims to alleviate the burden of hidden costs associated with production and distribution for Indian exporters, making their goods more attractive in the global market. However, the United States (US) and the European Union (EU) have imposed countervailing duties (CVD) on certain Indian products benefiting from the RODTEP scheme. The US and EU argue that the scheme constitutes an unfair export subsidy, violating World Trade Organization (WTO) rules. This following will delve into the nuances of the RODTEP scheme, its impact on Indian exports, and the complex trade relations it has engendered with its major partners.

Understanding the RODTEP Scheme

The RODTEP scheme seeks to neutralize the taxes and duties on export products that are not otherwise credited or remitted. By refunding these costs, the Indian government aspires to ease the burden on exporters and make Indian goods more competitive globally. Consequently, this helps address the issue of hidden costs that often make Indian products less attractive or unaffordable to foreign buyers.

The scheme’s primary purpose is to boost the Indian economy and promote its exports by reducing the production and distribution costs associated with exporting. By doing so, it ensures that Indian exporters can offer their products at a more competitive price, ultimately facilitating the expansion of their businesses in international markets. The RODTEP scheme operates within the framework of prevailing WTO regulations.

The WTO Ruling and Imposition of CVD

The controversy surrounding the RODTEP scheme stems from the validity of export subsidies under WTO regulations. In 2019, a WTO panel ruled against India, stating that its export subsidy programs, including those similar to RODTEP, violated the norms established by the trade body.

As a consequence of this ruling, the US and EU swiftly imposed countervailing duties on several Indian products that benefit from the RODTEP scheme. The countervailing duties are levied on these imports to offset the effect of subsidies provided by the Indian government, in accordance with WTO rules.

Trade Relations and Dispute Resolution

The imposition of countervailing duties by the US and EU has engendered a trade dispute between India and its major partners. India contends that its RODTEP scheme adheres to WTO regulations and is necessary for its economic development. It insists that RODTEP is designed to neutralize non-creditable taxes and duties, rather than serve as an export subsidy that violates WTO rules.

On the other hand, the US and EU argue that the RODTEP scheme creates an uneven playing field and unfairly advantages Indian exporters, ultimately harming domestic industries and workers in their respective countries. They contend that the scheme distorts the market and triggers trade imbalances.

The dispute between India and its major partners is likely to continue until a mutually acceptable solution is found. Both sides are expected to engage in negotiations and explore alternatives that strike a balance between fostering economic growth and adhering to WTO rules.

The RODTEP scheme introduced by the Indian government aims to boost the competitiveness of its export products by refunding taxes and duties that are not credited or remitted otherwise. However, the US and EU view the scheme as an export subsidy that violates WTO regulations. Consequently, they have imposed countervailing duties on certain Indian products benefiting from the RODTEP scheme.

While India maintains that the RODTEP scheme is WTO compliant and essential for its economic growth, its major partners claim that it distorts the market and disadvantages domestic industries. The ongoing dispute highlights the intricacies of international trade and the challenges countries face in striking a balance between trade promotion and adherence to established trade rules.

As the dispute continues, it is crucial for all parties involved to engage in productive negotiations and explore mutually agreeable solutions. This will help ensure that global trade remains fair, transparent, and beneficial for all nations involved.

References:

FREQUENTLY ASKED QUESTIONS (FAQs) ON RoDTEP SCHEME – IceGate. (n.d.). Retrieved from https://cip.icegate.gov.in/CIP/static/images/doc/RoDTEP/FAQ2.pdf.

RoDTEP Scheme: Benefits, Requirements, and Full Form. (n.d.). Retrieved from https://www.businessgo.hsbc.com/en/article/rodtep-scheme-benefits-and-requirements-for-indian-exporters.

RODTEP SCHEME – The Economic Times. (n.d.). Retrieved from https://economictimes.indiatimes.com/topic/RoDTEP-scheme.

RoDTEP Scheme: Rates, Guidelines, Eligibility, Features, Benefits. (n.d.). Retrieved from https://cleartax.in/s/rodtep-scheme.

WTO ruling on Indian export subsidies: Tackling contradictions of the …. (n.d.). Retrieved from https://www.orfonline.org/expert-speak/wto-ruling-on-indian-export-subsidies-tackling-contradictions-of-the-agreement-on-subsidies-and-countervailing-measures-58266/.

Leave a comment