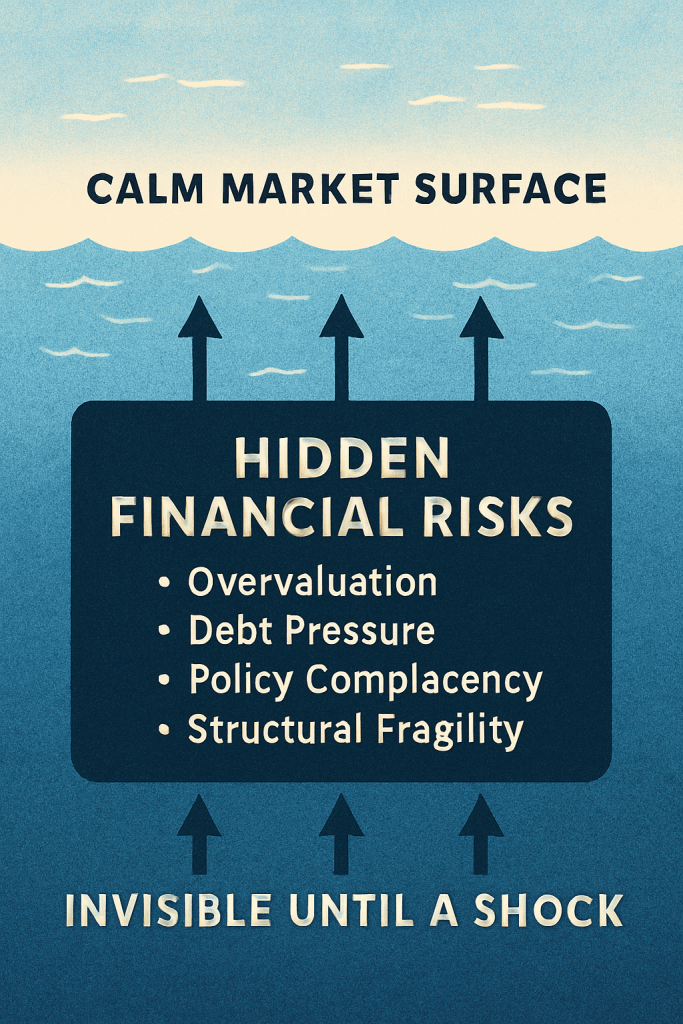

For decades, policymakers, investors, and businesses have trained their eyes on the ebb and flow of economic cycles—booms, recessions, recoveries, corrections. Yet the real dangers to the global economy often lie beneath the surface, in structural vulnerabilities that accumulate quietly over years. Recent assessments, including global financial stability reviews and commentary from major economic institutions, show that valuation excesses, policy complacency, and institutional blind spots now pose far deeper risks than short-term downturns.

The lesson is clear: the next disruption may not be caused by familiar cyclical triggers like inflation spikes or monetary tightening. It may instead emerge from the system’s own architecture — the way we value assets, price risk, and govern financial flows in an era of unprecedented liquidity and geopolitical strain.

Cycles Hurt, Structures Destroy

Economic cycles have always defined modern economies. The post-war expansions of the 1950s, the oil shocks of the 1970s, the dot-com boom of the late 1990s, and the 2008 global financial crisis all followed recognisable patterns of overheating and correction.

But history also shows that structural fragilities amplify the severity of these downturns:

In 1929, inflated stock valuations driven by excessive leverage turned a market correction into the Great Depression.

In 2008, reckless mortgage securitisation and shadow-banking opacity transformed a housing slump into a systemic collapse.

During the Asian Financial Crisis of 1997, currency mismatches and financial liberalisation without supervision triggered devastating contagion across emerging markets.

The pattern is unmistakable. Cycles start the storm; structural weaknesses decide the damage.

The New Age of Valuation Excesses

Today’s financial markets operate under historically unusual conditions:

Global equities remain priced far above long-term trend values in many major economies.

Real estate in several countries exceeds affordability metrics by margins not seen since pre-2008 years.

Venture capital and private equity valuations grew faster than underlying cash flows, encouraged by excess liquidity between 2020–2022.

These valuation excesses are not a normal by-product of growth. They are the result of an extended period of ultra-low interest rates, global capital spillovers, and digital-driven investor enthusiasm.

Such overstretched valuations create systemic risk because:

1. Corrections become sharper, affecting household wealth and corporate balance sheets.

2. Debt servicing costs rise disproportionately when interest rates adjust.

3. Financial contagion accelerates, especially through leveraged investors.

Markets today appear calm, but the calmness itself reflects complacency — not stability.

Policy Complacency Is Becoming a Risk in Itself

A striking concern is that many policymakers still assume global finance is more resilient after the regulatory reforms of 2008. While capital buffers and stress tests have improved bank strength, risks have migrated to less regulated segments:

Private credit markets

Complex derivatives

Digital assets and algorithmic finance

Sovereign debt exposure in emerging markets

Pension funds with leveraged strategies

Moreover, the belief that central banks will always intervene to stabilise markets encourages moral hazard. This “central bank put” has led investors to take riskier bets, assuming policymakers will rescue markets if needed.

But in an era of high public debt, geopolitical competition, and constrained monetary space, that assumption may no longer hold.

The Next Shock May Not Come From Where We Expect

Cyclical risks—like inflation waves, recession fears, or commodity price fluctuations—are visible and widely debated. But structural vulnerabilities often accumulate invisibly inside:

Asset bubbles

Underpriced risk

Financial engineering with limited oversight

National debt levels crossing sustainable thresholds

Cross-border capital dependence on geopolitically sensitive regions

If a negative event collides with these structural issues—such as sudden rate hikes, geopolitical crises, or liquidity shortages—the fallout could be disproportionately large.

2020 showed how a shock (the pandemic) could rapidly expose these hidden weaknesses. Liquidity evaporated in even the safest assets until central banks had to intervene massively.

Where the Next Vulnerabilities May Grow

Looking ahead to 2030 and beyond, several evolving trends will shape financial fragility:

1. AI-Driven Trading Risks

Algorithmic and AI-generated trading decisions could amplify volatility, creating ultra-fast contagion during stress.

2. Green Transition Asset Repricing

Carbon-intensive assets may face sudden devaluation, while green investments could develop bubbles without proper risk modelling.

3. Demographic Imbalances

Ageing societies in Europe, China, Japan, and other regions may strain pension structures, increasing pressure on leveraged investment strategies.

4. Debt Supercycles

Public debt levels in advanced economies have reached post-war highs, limiting room for crisis-time interventions.

5. Fragmenting Global Finance

Geopolitical blocs (US-EU, China-Asia, BRICS-Plus) may create parallel financial ecosystems, increasing currency and liquidity risks.

Resilience Requires Seeing What We Prefer to Ignore

The global economy has become highly adaptive, but also highly fragile. Policymakers tend to focus on short-term indicators—quarterly growth, inflation, interest rates—while deeper systemic risks grow unnoticed. Financial markets may look healthy today, but beneath the surface lie valuation distortions, leverage dependencies, regulatory blind spots, and geopolitical mismatches.

The real danger is not a recession. It is the underestimation of structural fragility.

If economies are to remain resilient, governments, regulators, and investors must shift from reactive management to anticipatory governance — acknowledging that the next disruption may not resemble anything from the past. #FinancialStability

#MarketVulnerabilities

#ValuationExcess

#PolicyComplacency

#SystemicRisk

#AssetBubbles

#GlobalFinance

#EconomicFragility

#GeopoliticalRisk

#FutureOutlook

Leave a comment