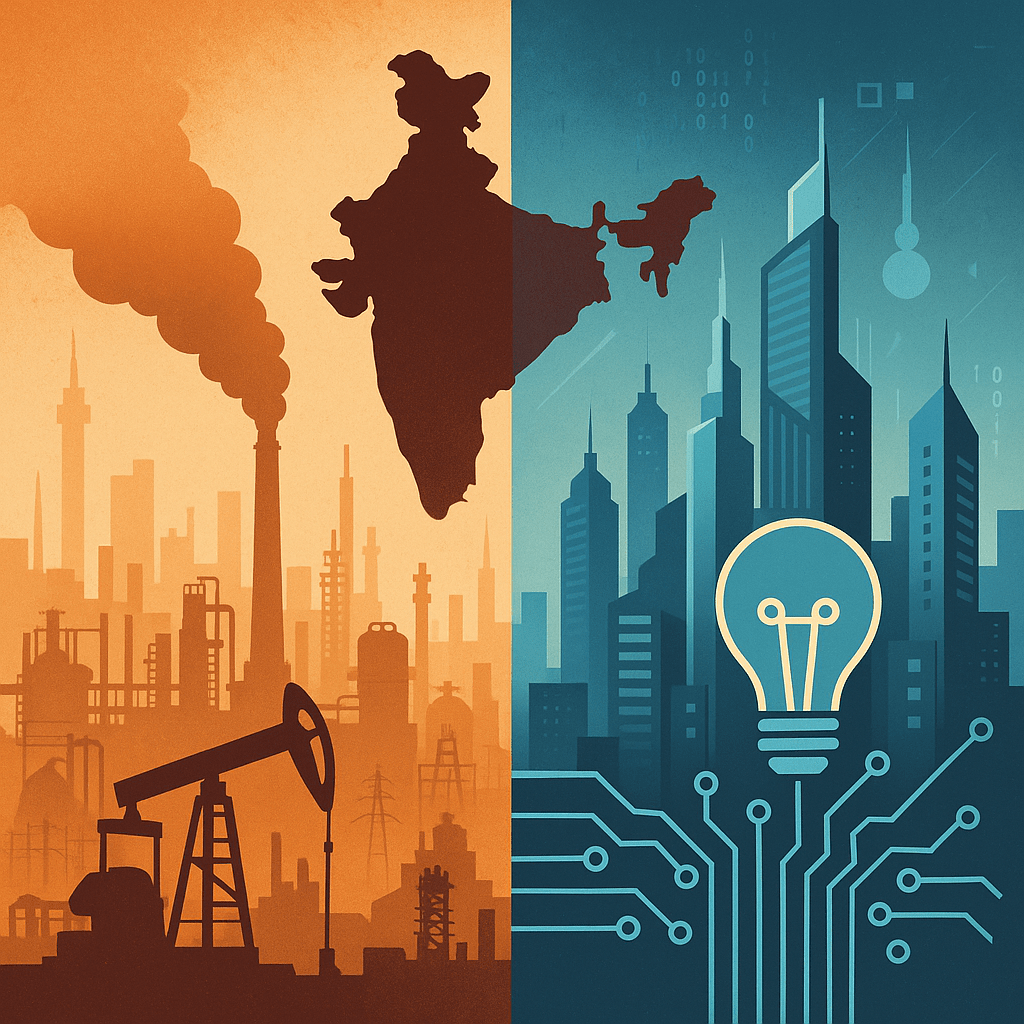

From Industrial Titans to Innovation Laggards

India’s richest entrepreneurs have long reflected the country’s industrial DNA — built on oil, coal, steel, and cement. This legacy, while pivotal during the post-independence decades of nation-building, has also created a structural inertia. From the steel plants of the 1950s to the power conglomerates of the 1990s, wealth in India has consistently been tied to physical assets, natural resources, and large-scale infrastructure — not to intellectual property, innovation, or frontier technologies.

This dominance of resource-based wealth creation was understandable in a capital-scarce, developing economy. But in today’s knowledge-driven world, it increasingly highlights a deep economic imbalance — one where capital is misallocated toward tangible assets rather than intangible innovation.

The Capital Allocation Conundrum

At the heart of the issue lies what economists call a capital misallocation trap. Too much financial muscle flows into commodity trading, real estate, and traditional industries — sectors that offer quick, tangible returns but limited productivity gains or global competitiveness.

Meanwhile, India’s innovation-driven sectors — deep-tech, biotechnology, AI, clean energy, and design-led manufacturing — remain chronically underfunded. Despite India’s global reputation for software talent and startup dynamism, the top echelons of Indian wealth still mirror the industrial barons of the past rather than the tech visionaries of the future.

This creates a systemic feedback loop:

Banks and investors continue to lend to asset-heavy companies with established collateral.

Startups and innovators face long gestation cycles with limited risk capital.

Policy frameworks remain tilted toward scale, not experimentation.

The Innovation Dividend

Contrast this with the United States, where the richest individuals derive wealth from technology and intellectual property — Microsoft, Google, Amazon, Tesla, NVIDIA. Their rise transformed not just balance sheets but national productivity, export strength, and soft power.

In East Asia, too, wealth creation has evolved rapidly — South Korea’s chaebols reinvented themselves around semiconductors and advanced electronics; China’s billionaires now emerge from e-commerce, AI, and renewable energy ecosystems.

India, in comparison, risks being stuck between two worlds: too advanced to rely solely on natural resources, yet too risk-averse to fully fund frontier innovation.

Re-Engineering India’s Capital Flow

For India to truly climb the global value chain, a strategic reallocation of capital is imperative. This involves a multi-layered transformation:

1. Deep-Tech Financing:

Create specialized venture debt and equity vehicles for deep-tech and patent-intensive startups — especially in AI, robotics, and clean technologies.

2. Long-Horizon Investment Reform:

Shift institutional investor mandates (pension funds, insurance firms) to allow exposure to innovation-driven enterprises with longer gestation periods.

3. IP-Centric Policy Incentives:

Reward R&D investment through tax credits, sovereign IP funds, and simplified patent monetization frameworks.

4. Public-Private Innovation Clusters:

Build technology parks focused on research-commercialization linkages — bridging academia, startups, and manufacturing.

5. Cultural and Educational Reset:

Encourage universities to nurture risk-taking, design thinking, and commercialization of ideas — not just academic excellence.

The Wealth of Nations is Changing

India’s current wealth map may deliver stability, but not sustainability. As global trade, technology, and energy paradigms shift, nations that fail to pivot from resource rents to knowledge rents risk economic stagnation.

If India continues to allocate its capital predominantly to traditional sectors, it may secure short-term growth but lose long-term strategic advantage. The next wave of Indian billionaires should ideally come not from cement kilns and oil wells, but from laboratories, AI models, and design studios.

The future of Indian capitalism will be defined by whether it can transform wealth from the ground to wealth of the mind — where ideas, not iron, build the nation’s next industrial revolution.

#IndiaWealth #InnovationEconomy #DeepTech #CapitalReform #StartupEcosystem #IPRIndia #EconomicTransformation #PolicyReform #IndustrialTransition #FutureOfGrowth

Leave a comment