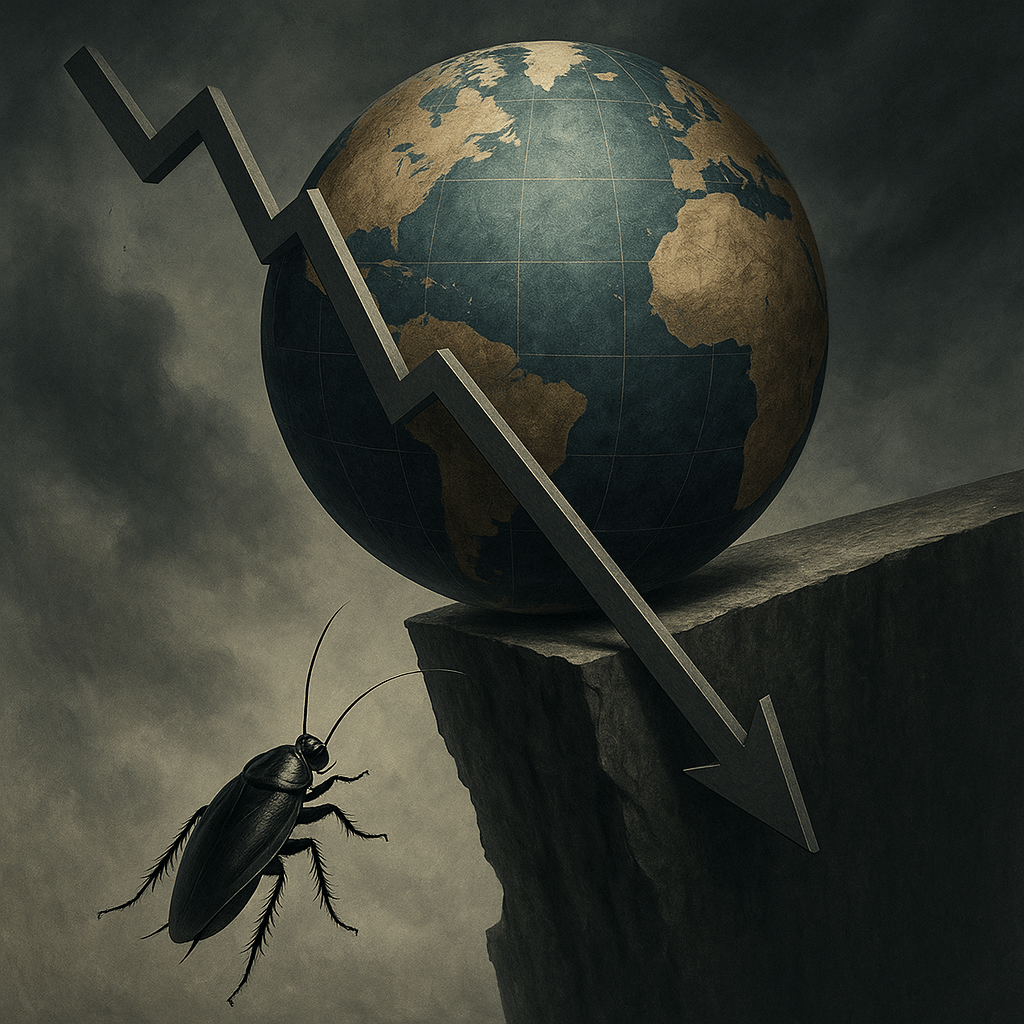

The recent warning from UK authorities about a potential “bumpy landing,” coupled with JPMorgan CEO Jamie Dimon’s caution regarding “more cockroaches” lurking in the global financial system, captures the uneasy balance between post-pandemic recovery and mounting systemic risks. Beneath the veneer of stability lies a world economy grappling with deep structural imbalances—an echo of past crises, yet shaped by distinctly 21st-century dynamics.

From Great Moderation to Great Volatility

In the early 2000s, policymakers celebrated a period of stable inflation, steady growth, and controlled financial cycles—the so-called “Great Moderation.” But history has since shown that stability can breed complacency. The 2008 global financial crisis exposed how hidden risks—complex derivatives, opaque lending, and excessive leverage—can accumulate in the shadows. Today, similar patterns re-emerge in new forms: private credit markets, leveraged corporate debt, and non-bank financial institutions that operate beyond traditional regulation.

The UK’s present warning reflects a déjà vu moment. Tight financial conditions, volatile trade flows, and stubborn inflation have made policymakers wary of the next shockwave. Inflation, while receding, remains above the Bank of England’s 2% target, and consumer prices are sticky due to high energy costs, wage pressures, and persistent supply disruptions.

The Warning Signs: Fragile Foundations

Dimon’s metaphor of “more cockroaches” alludes to the hidden weaknesses in global credit markets—once you find one, there are likely many more. Corporate balance sheets are stretched after years of cheap money. As interest rates remain elevated, debt servicing costs rise sharply, threatening highly leveraged firms. The “shadow banking” sector—comprising private equity funds, hedge funds, and non-bank lenders—has become a central source of systemic risk, holding trillions in assets with limited oversight.

The UK’s open economy amplifies these vulnerabilities. Volatile trade patterns post-Brexit, currency fluctuations, and a delicate real estate sector combine to create a complex macroeconomic puzzle. Globally, the risks are interconnected: U.S. bond market turbulence, China’s property sector slump, and Europe’s fiscal tightening form a chain of fragility.

The Structural Shift: From Credit Cycles to Complexity Cycles

Unlike past crises driven purely by credit excess, today’s global economy faces complexity risk. Financial innovations like algorithmic trading, tokenized assets, and AI-driven credit models make markets faster—but also more opaque. Regulation often lags behind innovation. The intertwining of public and private finance, particularly through sovereign wealth funds and institutional investors, means shocks in one domain can cascade rapidly across borders.

This raises a deeper question: Are we transitioning from an era of quantitative easing to one of quantitative fragility? Policymakers may no longer have the same fiscal or monetary ammunition to cushion the next downturn. The IMF’s latest reports suggest that even a mild financial disruption could shave 1–2% off global GDP growth, particularly hitting small economies with large foreign exposures.

Toward a New Financial Architecture

Looking forward, the world must evolve beyond reactive firefighting. The “bumpy landing” may serve as a necessary recalibration—an opportunity to strengthen transparency, modernize regulation, and realign growth with resilience. Future-ready economies will need:

AI-enhanced stress testing to detect shadow-sector vulnerabilities.

Digital transparency frameworks to monitor cross-border capital flows in real time.

Resilient fiscal design, ensuring buffers against global shocks.

Ethical AI and governance reforms, especially in algorithmic finance.

Financial fragility, if unchecked, could once again morph into a full-blown systemic crisis. But if policymakers internalize the lessons of history and harness the tools of the future, the “bumpy landing” could become a soft one—laying the groundwork for a more transparent and sustainable financial era.

Learning From the Past, Preparing for Tomorrow

The UK’s economic caution and Dimon’s warnings are not mere pessimism—they’re reflections of accumulated global fragilities. Every financial cycle has its hidden risks; what defines resilience is how quickly institutions recognize and mitigate them. As inflation bites and credit stress deepens, the challenge for 2025 and beyond will be balancing vigilance with innovation. The next crisis may not stem from where we last looked—but from where we failed to.

#GlobalEconomy #FinancialStability #JamieDimon #UKInflation #ShadowBanking #CorporateDebt #SystemicRisk #FutureFinance #MacroOutlook #EconomicResilience

Leave a comment