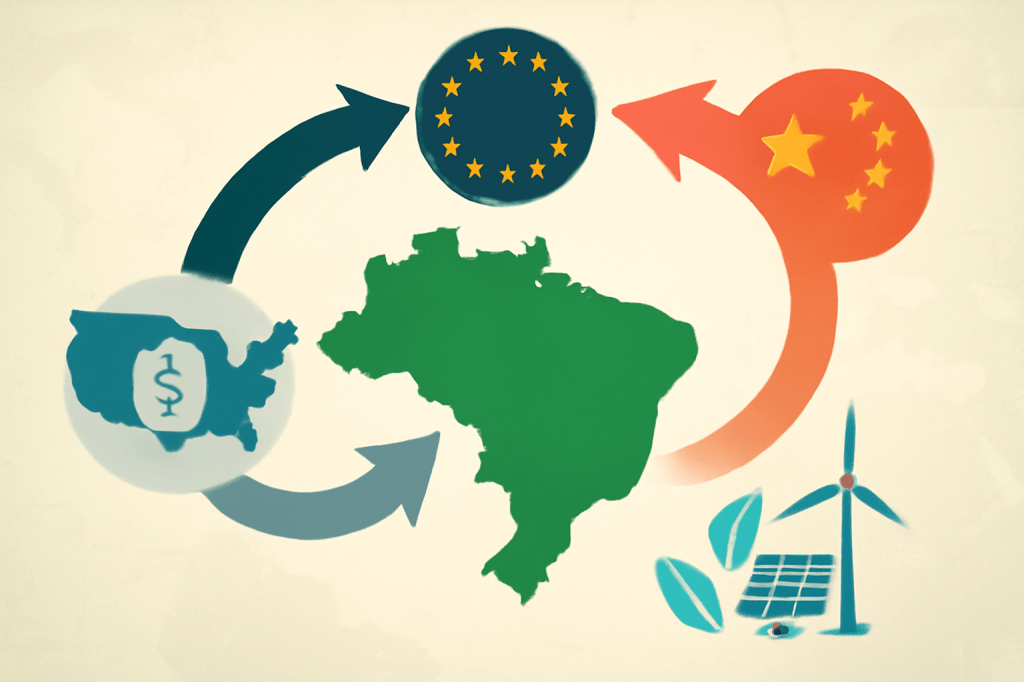

The recent imposition of 50% U.S. tariffs on key imports marks a turning point in Brazil’s global economic alignment. Historically tied to both the U.S. and China as a supplier of commodities, Brazil is now reconfiguring its trade priorities. This reorientation is not sudden but a deepening of trends already in motion — a pivot toward China and the European Union, reflecting a broader transformation in Latin America’s global integration strategy.

Historical Perspective: From Monroe to Multipolarity

For most of the 20th century, Latin America, including Brazil, operated within a U.S.-centric trade framework shaped by the Monroe Doctrine and subsequent economic arrangements. However, the early 21st century brought diversification. China’s entry into the WTO in 2001 and its surge in global demand for commodities redefined Brazil’s trade landscape. By 2024, 46% of Brazil’s crude oil and 71% of its iron ore exports were headed to China — a structural dependence that reflects both opportunity and vulnerability.

Europe, meanwhile, has remained a consistent buyer of agricultural and energy products, offering technological cooperation and investment in renewable energy. The EU-Mercosur trade agreement, though politically contentious, continues to signal Europe’s long-term interest in the region.

The Immediate Impact of U.S. Tariffs

The new U.S. tariffs, targeting a range of manufactured and processed goods, are accelerating Brazil’s strategic realignment. The tariffs not only make direct exports to the U.S. less viable but also disrupt regional supply chains dependent on the U.S. market. In response, Mexico and Argentina are emerging as re-export hubs under the USMCA framework, helping maintain limited access to the U.S. market while Brazil diversifies its buyers and builds alternative corridors.

This maneuver underscores the complexity of global trade rules in the post-globalization era — where tariff arbitrage and re-export mechanisms serve as tools of adaptation rather than circumvention.

China’s Expanding Footprint

China’s deepening role in Brazil’s economy is not limited to trade volumes. Beijing has been steadily expanding its investment in Brazil’s energy, infrastructure, and digital sectors, including partnerships under the Belt and Road Initiative. The emphasis on logistics corridors, green energy, and port modernization aligns with Brazil’s national development priorities and provides an alternative to Western finance.

However, this growing dependence on China also exposes Brazil to geopolitical asymmetries — a reliance that could constrain policy flexibility if China’s domestic demand slows or its global strategy shifts.

Europe’s Strategic Re-engagement

Europe, sensing the risk of losing influence in Latin America, has been reinforcing its green diplomacy through climate-linked investments and supply-chain partnerships. European firms are increasingly looking to Brazil’s energy transition — including biofuels, wind, and hydrogen — as a way to secure sustainable inputs and meet carbon neutrality goals. In this sense, the Brazil–EU axis may emerge as a long-term stabilizer amid global trade fragmentation.

Latin America’s Adaptive Geometry

Across the continent, other economies are following suit. Mexico, positioned by geography and the USMCA framework, is recalibrating to serve as both a manufacturing bridge and re-export node. Argentina, with its agro-industrial base and growing ties to China, is diversifying energy exports, particularly in lithium and renewables.

Collectively, these dynamics are creating a multi-polar Latin American trade map, less defined by U.S. dominance and more by pragmatic alignment with multiple partners.

Critical Outlook: The Future of Trade Sovereignty

While Brazil’s trade pivot appears pragmatic, it raises deeper questions about strategic autonomy. The over-reliance on commodities in the China corridor could limit Brazil’s technological upgrading, while fragmented Western partnerships may delay infrastructure modernization.

To navigate this evolving terrain, Brazil will need to:

- Invest in value-added processing within mining, agriculture, and energy sectors.

- Strengthen intra-Latin American trade mechanisms like Mercosur and CELAC.

- Pursue digital trade and AI integration to remain competitive amid global technological shifts.

Futuristic Outlook: A South-South Reconfiguration

Looking ahead, the most plausible outcome is a South-South economic reconfiguration, where Brazil anchors a Latin American bloc integrated more deeply with Asia and parts of Africa. This could usher in a post-Western trade order — more diversified but also more complex, where national resilience depends on balancing between U.S. tariffs, Chinese capital, and European sustainability standards.

Brazil’s trade future, therefore, will not be about choosing sides but designing equilibrium — an active, data-driven, and strategically diversified engagement with multiple global centers of power.

#BrazilTradePivot

#USTariffsImpact

#ChinaBrazilRelations

#EULatinAmericaTrade

#GlobalSupplyChains

#MercosurIntegration

#TradeDiversification

#SouthSouthCooperation

#CommodityExports

#GeopoliticalEconomy

Leave a comment