A New Route in the Global Supply Chain

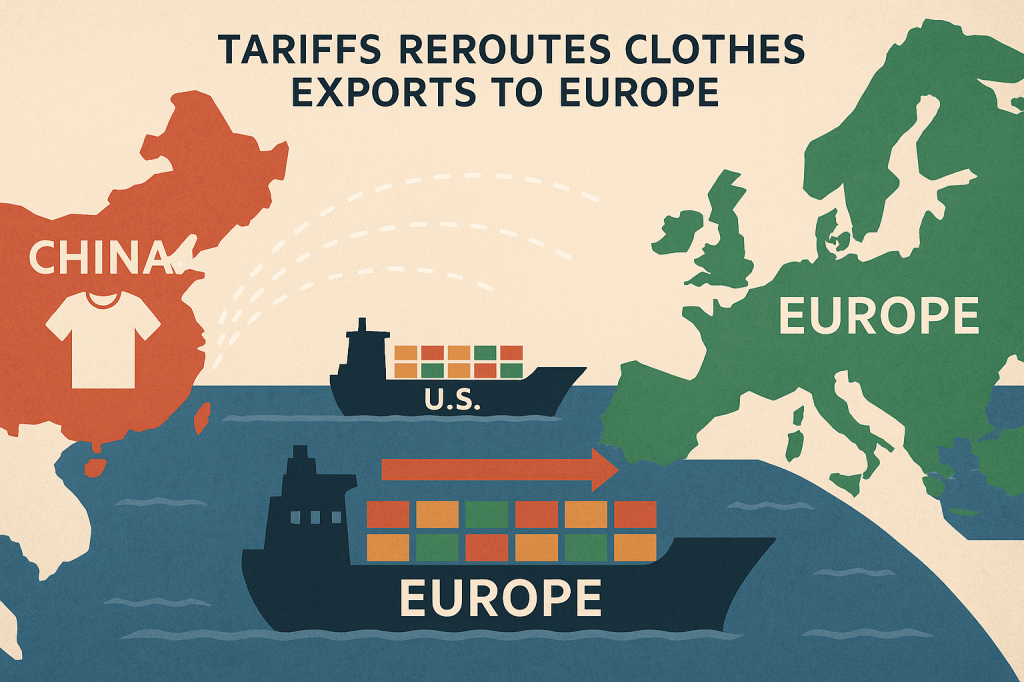

China’s textile exports to the European Union have surged sharply in 2025, as U.S. tariffs forced Chinese manufacturers to reroute their goods toward Europe. According to data from Euratex, the European textiles body, imports of Chinese clothing and textiles rose by 20% in both value and volume during the first half of 2025 compared to last year. The value jump—roughly €2 billion—was primarily driven by low-cost clothing, underscoring how trade restrictions can quickly reshape global supply chains.

This surge is not merely a commercial adjustment; it is a strategic realignment of China’s manufacturing networks. When the United States escalated tariffs on Chinese textiles under its new protectionist trade framework, Chinese exporters swiftly shifted focus to Europe’s open consumer markets. Historically, such redirections have occurred whenever global trade blocs introduced unilateral barriers—mirroring the 1980s’ redirection of Asian steel and electronics toward European and African markets following U.S. import curbs.

Europe’s Uneasy Position: Cheap Imports, Costly Dilemmas

The European textile industry now finds itself in a paradox. On one hand, cheap Chinese clothing offers relief to inflation-hit European consumers. On the other, European manufacturers face intense competition from aggressively priced imports, leading to concerns of market flooding and margin erosion. Euratex has publicly warned that these imports are arriving “in an aggressive way,” raising fears of deindustrialization pressure across small and medium textile hubs in countries like Italy, Spain, and Portugal.

The EU has long struggled to regulate the tsunami of low-value parcels entering the bloc through e-commerce giants such as Shein and Temu. Customs loopholes—especially under the de minimis rule exempting small parcels from duties—have effectively opened a backdoor for Chinese producers to penetrate European markets. Despite policy intentions to tighten oversight, enforcement remains slow and fragmented, echoing the EU’s broader difficulty in balancing open trade with industrial resilience.

Historical Parallels: The Textile Trade’s Cycles of Shift

History offers critical perspective. From the Multi-Fibre Arrangement (MFA) era of the 1970s to the post-WTO liberalization of the 2000s, textile production has constantly shifted to wherever cost efficiency meets market access. China’s dominance—once a product of its scale and labor cost advantage—is now sustained by its digital supply chains and vertical integration. Unlike earlier decades, where production migration took years, the post-pandemic trade architecture enables China to pivot markets within months through real-time logistics and AI-driven forecasting.

Data-Driven Analysis: Europe’s Growing Dependence

A closer look at trade dynamics highlights Europe’s growing dependence on external suppliers:

- EU imports from China: +20% in H1 2025 (Euratex)

- Total import value increase: ~€2 billion (largely fast fashion and synthetic blends)

- Top destinations within EU: Germany, France, Spain, and the Netherlands

- Domestic production: Down by an estimated 8% among EU SMEs in the same period

These numbers reflect an emerging structural imbalance—Europe consumes what it no longer produces. If unchecked, this trajectory may replicate the manufacturing hollowing-out seen in U.S. and UK industries over the past two decades.

Strategic Implications: A Looming Policy Crossroads

For policymakers, the question is not whether to shield Europe’s textile base, but how. A reactionary tariff wave could backfire, inflaming tensions with Beijing and disrupting retail sectors dependent on low-cost imports. Instead, Europe’s response must focus on competitiveness—investing in digitalized production, circular textiles, and sustainable materials that differentiate its products from mass-market Chinese offerings.

At the same time, China’s reorientation reveals resilience and adaptability. Its manufacturers are now less reliant on any single geography, embodying a “multi-hub” trade model that mitigates tariff risk. This pattern foreshadows a post-hegemonic era of global trade, where agility, not just scale, defines success.

Futuristic Outlook: The Next Fabric of Globalization

The rerouting of Chinese textile exports is more than a temporary market adjustment—it’s a signal of the next phase of globalization, one marked by shifting supply chains, algorithmic logistics, and fragmented trade blocs. As Europe becomes the new landing ground for redirected Chinese goods, the continent faces a defining test: can it uphold fair competition and sustainability without retreating into protectionism?

For China, this pivot is an early rehearsal for a multipolar trade future, where no single market dominates its export calculus. For Europe, it’s a reminder that the true challenge of globalization 2.0 lies not in blocking the flow of goods—but in reengineering industrial ecosystems that can compete, innovate, and sustain amid relentless global flux.

#ChinaTrade #EUTextiles #GlobalSupplyChains #TariffWar #FastFashion #Euratex #IndustrialPolicy #SustainableManufacturing #TradeDiversification #GlobalEconomy

Leave a comment