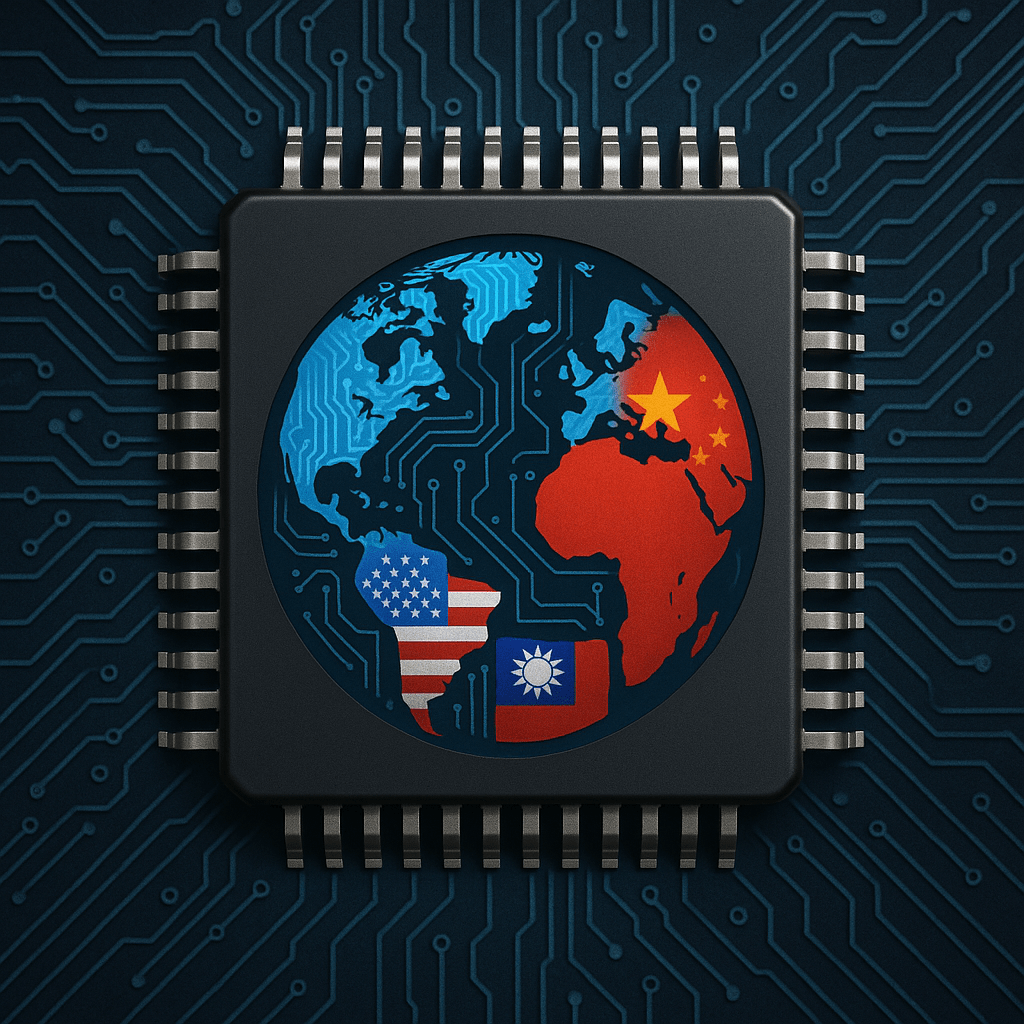

In the 21st century, wars are not fought only with missiles or troops — they are fought with microchips. The so-called “Chip War” represents one of the most defining geopolitical, economic, and technological rivalries of our age. It is not a war of bullets but of bytes, where nations compete to dominate the most critical technology of the digital era: the semiconductor.

Semiconductors — tiny silicon wafers that power everything from smartphones and satellites to supercomputers and fighter jets — are the invisible engines of the modern world. Whoever controls their design, production, and distribution controls the digital and defense infrastructure of the future.

Historical Perspective: From Silicon Valley to Strategic Assets

The story of semiconductors begins in the 1950s and 1960s, when the U.S. pioneered the technology that powered the early computer revolution. Silicon Valley emerged as the global hub for innovation, giving birth to companies like Intel, Fairchild Semiconductor, and later NVIDIA and Qualcomm.

By the 1980s and 1990s, Japan and South Korea entered the race, leading in memory chips and manufacturing. The real shift, however, came in the 2000s, when Taiwan emerged as the epicenter of chip fabrication through TSMC (Taiwan Semiconductor Manufacturing Company) — a company that redefined the global production model by manufacturing chips for others (known as the foundry model).

Over time, the semiconductor supply chain became deeply fragmented yet globally interdependent — chip design might occur in the U.S., equipment could come from the Netherlands, and fabrication might happen in Taiwan or South Korea. This interdependence created both strength and vulnerability.

What is the “Chip War”?

The Chip War refers to the strategic contest over who controls semiconductor technology — and by extension, the next wave of economic and military power.

1. Strategic Importance

Semiconductors are the foundation of artificial intelligence, telecommunications, defense systems, quantum computing, and even the global financial infrastructure. They determine the performance of machines that run the world — from data centers to drones. Nations now treat chips not merely as commercial goods but as national security assets.

2. Supply Chain Complexity

The semiconductor supply chain involves highly specialized steps:

Design (by firms like NVIDIA, AMD, Qualcomm)

Fabrication / Foundry (by TSMC, Samsung, Intel)

Equipment and Materials (by ASML, Applied Materials, Tokyo Electron)

No country controls all stages, and this interdependence has made the system both efficient and fragile.

3. Technological Edge via Node Scaling

At the heart of the chip race is the shrinking nanometre node — the scale at which transistors are printed on silicon. The smaller the node (e.g., 3nm or 2nm), the more powerful and efficient the chip. Mastery of this scale determines technological supremacy, and only a few companies can produce at these leading-edge levels.

4. Export Controls and Trade Restrictions

The United States has weaponized its technological dominance by imposing export bans on advanced chips and manufacturing equipment, especially targeting China. These restrictions prevent Chinese firms from accessing or replicating the most sophisticated technologies. Subsidies like the U.S. CHIPS and Science Act (2022) and similar EU and Japanese initiatives aim to restore domestic manufacturing capacity.

5. Risk of Disruptions and Geographic Concentration

Over 90% of the world’s most advanced chips are produced in Taiwan, making global supply chains highly vulnerable. Any political instability, military conflict, or natural disaster in the region could send shockwaves through the global economy — halting production in industries from automobiles to aerospace.

Three Companies That Define the Chip War

1. TSMC (Taiwan Semiconductor Manufacturing Company)

TSMC is the crown jewel of global chipmaking. It produces chips for tech giants like Apple, NVIDIA, AMD, and Qualcomm, dominating over 60% of the global foundry market. Its unmatched mastery of 3nm and 5nm process nodes makes it indispensable. In a sense, TSMC holds the world’s digital future in its cleanrooms in Hsinchu, Taiwan.

2. Samsung Electronics (South Korea)

Samsung is both a memory chip leader and a strong contender in advanced logic chips. Its dual role — as a producer of DRAM, NAND, and system semiconductors — makes it a strategic powerhouse. Backed by massive R&D spending, Samsung competes head-to-head with TSMC in next-generation chip fabrication, especially at 3nm and below.

3. ASML Holding (Netherlands)

ASML may not produce chips, but without it, no one else can. It is the only company in the world capable of manufacturing Extreme Ultraviolet Lithography (EUV) machines — the indispensable tools required to print the tiniest transistors on a chip. Each EUV machine costs over $150 million and contains over 100,000 components. ASML’s near-monopoly makes it the “kingmaker” of the semiconductor industry.

(Some analysts add Intel as a fourth pillar, given its vertical integration and renewed push to reclaim leadership in U.S. chipmaking.)

Geopolitical Frontlines: U.S., China, and the Global Chessboard

The chip war today mirrors the Cold War rivalry, but in digital form. The U.S. aims to maintain dominance through innovation, export restrictions, and strategic alliances with Japan, South Korea, and the Netherlands.

China, on the other hand, has invested heavily under its “Made in China 2025” initiative to achieve semiconductor self-sufficiency. While China lags in advanced lithography and design, it leads in packaging, assembly, and some AI accelerator chips. Its long-term goal is to decouple from Western technology dependencies.

The European Union and India are also joining the race. The EU’s Chips Act seeks to double its semiconductor market share by 2030, while India’s Semicon India Mission offers massive incentives to attract global fabs and develop domestic design talent.

Critical and Futuristic Outlook: The Next Phase of the Chip War

The semiconductor rivalry is shifting from hardware dominance to ecosystem control. The next decade will see three defining trends:

1. AI and Quantum Integration – Chips optimized for AI (like NVIDIA’s GPUs) and quantum computing processors will define future capabilities, from defense simulations to climate modeling.

2. Localization and Friend-shoring – Nations are reconfiguring supply chains to align with political allies (“friend-shoring”), reducing dependence on adversarial states.

3. Energy and Sustainability Pressure – As chip fabrication consumes massive energy and ultra-pure water, sustainability will become a competitive differentiator in the future semiconductor race.

In essence, the chip war will determine who leads the next industrial revolution — a digital and data-driven revolution that extends beyond economics into national sovereignty itself.

The “Chip War” is more than an economic contest — it’s a battle for digital dominance. It reshapes alliances, dictates trade policies, and even influences the course of global peace and conflict.

From the laboratories of ASML to the fabrication lines of TSMC and the R&D hubs of Samsung, the future of global power is being written — one transistor at a time.

#ChipWar #Semiconductors #TSMC #Samsung #ASML #Geopolitics #ArtificialIntelligence #TechPolicy #SupplyChain #FutureOfTechnology

Leave a comment