The global diamond industry in 2025 is at a crossroads, driven by shifting consumer preferences, technological disruption, and a heated debate over the future of luxury and authenticity. At the heart of this transformation lies a polarizing contest between lab-grown diamonds (LGDs) and natural diamonds—two products chemically identical yet drastically divergent in terms of value perception, pricing, and market positioning. As the industry adjusts to a new equilibrium, questions around sustainability, affordability, and investment-worthiness are redefining consumer behavior and shaking traditional business models.

The Demand Shift: Sustainability vs. Rarity

Lab-grown diamonds, once a niche innovation, have evolved into a global force. The lab-grown diamond market has exploded to an estimated $29.7 billion in 2025, and projections suggest it could cross $97 billion by 2034, growing at a compound annual rate of over 14%[^1]. What’s fueling this growth is not just affordability, but a generational change in priorities. Millennials and Gen Z consumers, who value ethical sourcing and environmental responsibility, increasingly see LGDs as a smarter, more conscious alternative to mined stones[^2].

In India, LGDs are booming, particularly in the fashion and everyday-wear segments. Aggressive innovation and a robust manufacturing base—particularly in cities like Surat—have enabled Indian producers to offer high-quality lab diamonds at competitive prices[^3]. Globally, LGDs now make up around 20% of total diamond sales, a massive leap from less than 1% just a decade ago[^1].

On the other hand, natural diamonds—backed by centuries of symbolism, cultural relevance, and geological rarity—are staging a quiet comeback after a sharp correction in 2023–24. Early signs of recovery are evident in 2025, especially in top markets like the US and India, which together account for a significant chunk of global demand[^4][^5]. India alone now holds nearly 11% of global natural diamond consumption[^5]. The overall diamond jewelry market (combining both natural and lab-grown stones) is expected to grow at around 5% CAGR through 2030, driven by luxury gifting and rising affluence[^6].

The Pricing Debate: Collapse vs. Correction

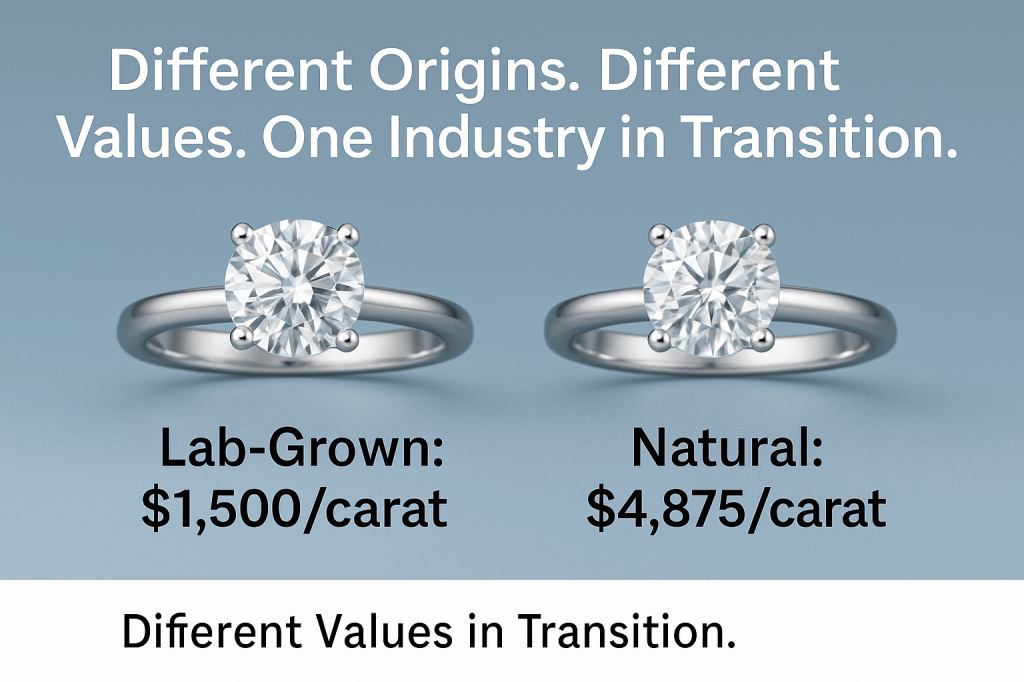

The core of the current controversy, however, lies in pricing—and here the difference is stark.

Lab-grown diamond prices have plummeted. Technological advancements, abundant supply, and minimal entry barriers have pushed prices down drastically. As of 2025, LGDs are priced around $1,500 per carat, compared to $4,875 for mined diamonds—a gap of 80–90%[^8]. From their 2015 levels, LGD prices have dropped by a staggering 74% to 95%, with analysts predicting further falls of 50–80% as economies of scale continue to improve[^2][^9].

This has sparked concern among investors and jewelers alike. Unlike natural diamonds, LGDs do not benefit from constrained supply or perception of rarity. As a result, used lab diamonds command little to no resale value. Some industry voices have labeled them a “poor investment” or even a “scam”, especially when consumers are unaware of the dramatic value erosion upon resale[^10].

Natural diamonds, too, have faced price challenges. Prices fell by 26–40% from the post-pandemic high in 2021–2022. So far in 2025, there’s been a further 1–2% drop[^11][^13]. Contributing factors include excess inventories, sluggish demand in China, and the competition posed by cheaper LGDs. However, the strategy from major players like De Beers has been to reduce production—cutting output by up to 20%—in an effort to support prices by shifting focus from volume to value[^11][^12].

Unlike LGDs, natural diamonds benefit from a controlled supply ecosystem. This allows the industry to manage price volatility better and retain a sense of luxury. Consumers still associate natural diamonds with investment value, romantic symbolism, and generational legacy—attributes that lab diamonds, despite their appeal, struggle to replicate[^10][^12].

Market Realignment and Consumer Confusion

This divergence in price and perception has created a bifurcated market. One segment leans toward accessible luxury—affordable, trendy, and sustainable LGDs for personal use and gifting. The other remains loyal to heritage luxury, favoring the authenticity, rarity, and resale value of natural stones.

But this growing divergence has also triggered confusion. Retailers are often accused of ambiguous marketing, with some failing to clearly differentiate lab-grown from natural diamonds. This has prompted regulatory responses. In India, for instance, consumer protection bodies are introducing mandatory labeling and transparency guidelines, seeking to protect buyers and ensure informed choices[^3].

The ethical debate is also heating up. While lab-grown diamonds promote sustainability—consuming less land and avoiding human rights issues linked with traditional mining—some experts argue that their carbon footprint can still be significant if the energy used is not from renewable sources. On the other hand, the natural diamond sector has made progress in traceability and responsible sourcing, but skepticism remains among eco-conscious buyers.

Strategic Takeaways for the Industry

- Lab-grown diamonds offer unmatched affordability but continue to face steep price depreciation and resale challenges. Their market expansion is undeniable, but their role is likely to remain focused on fashion, not investment.

- Natural diamonds, while under pressure, retain consumer loyalty in the luxury and legacy segments. Supply discipline and marketing emphasizing rarity will remain key to their value proposition.

- Consumer education and transparency are essential. The coexistence of two diamond ecosystems calls for clearer distinctions, responsible marketing, and trust-building.

- The future is not lab vs natural—but lab and natural. As the diamond world redefines itself, coexistence through market segmentation appears to be the most sustainable outcome.

The diamond industry in 2025 is witnessing a once-in-a-generation transformation. The rapid rise of lab-grown diamonds has democratized access to fine jewelry, while natural diamonds are reasserting their dominance in the world of legacy and luxury. But beneath the surface lies a complex web of market realignment, pricing volatility, and shifting consumer values. Whether the future belongs to carbon created in a lab or formed over billions of years beneath the Earth’s crust, one thing is certain: the diamond industry will never be the same again.

#LabGrownDiamonds

#NaturalDiamonds

#DiamondPrices

#SustainableJewelry

#DiamondMarket2025

#LuxuryVsAffordability

#DiamondInvestment

#MillennialBuyers

#JewelryIndustryTrends

#EthicalSourcing

Leave a comment