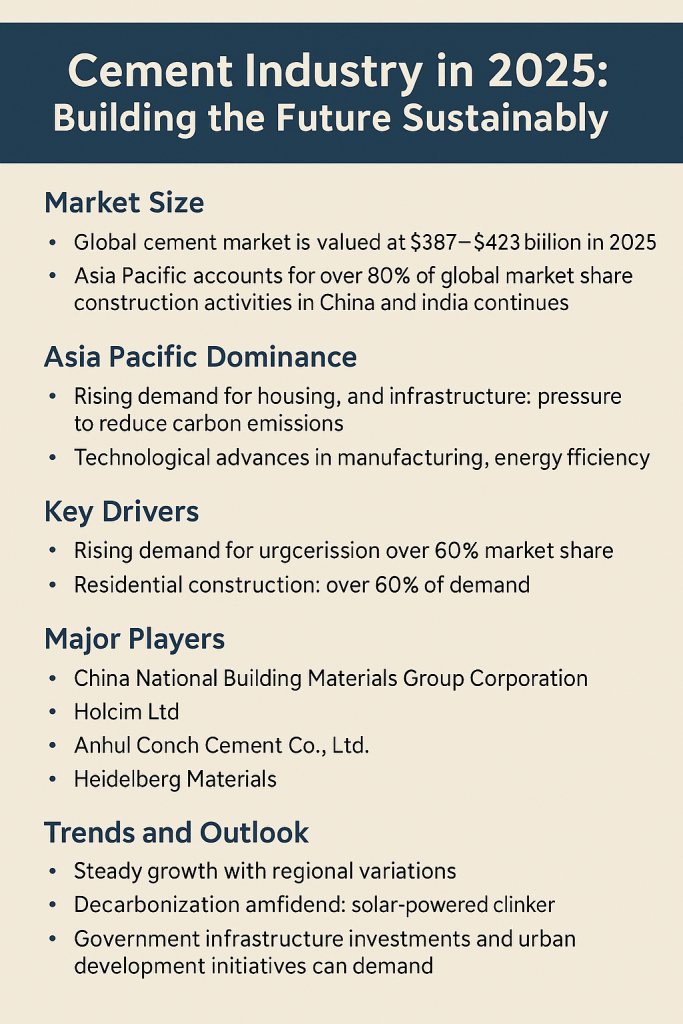

As the backbone of global infrastructure, the cement industry in 2025 stands at a pivotal intersection of growth and transformation. With its market size estimated between $387 and $423 billion, the sector is not only expanding but also evolving in response to urbanization pressures, technological shifts, and growing climate imperatives. Over the next decade, the market is forecasted to surge to $674–$744 billion, reflecting both opportunity and challenge for industry stakeholders.

Asia Pacific: The Engine of Growth

More than 80% of global cement demand in 2025 originates from the Asia Pacific region, with China and India at the forefront. The growth here is underpinned by three core factors:

1. Rapid Urbanization: Emerging economies are undergoing massive rural-to-urban migration, prompting exponential demand for residential and commercial infrastructure.

2. Mega Infrastructure Projects: From India’s Smart Cities Mission to Southeast Asia’s cross-border logistics corridors, cement remains a key enabler.

3. Demographic Expansion: A growing middle class and rising population density are accelerating housing and urban planning needs.

In contrast, Western economies are experiencing a slower recovery in construction demand, with mature markets reaching saturation and facing tighter environmental norms.

Sustainability: A Concrete Concern

Cement manufacturing is notoriously carbon-intensive, contributing about 1.5% of global CO₂ emissions. In 2025, this environmental challenge has moved to the forefront of industry priorities. Regulations are tightening, and market demand is shifting toward green construction materials. Consequently, companies are investing in:

Low-carbon cement technologies

Solar-heated clinker kilns

Recycled aggregates and materials

Carbon capture and utilization (CCU) systems

This push for decarbonization is no longer optional—it’s a competitive necessity. Firms that fail to innovate risk being sidelined in procurement decisions influenced by sustainability metrics and ESG scoring.

Innovation and Efficiency: Shaping a Smarter Industry

Technological innovation is redefining production and efficiency benchmarks. Modern cement plants are increasingly adopting:

AI-based process optimization

Waste heat recovery systems

Alternative fuels from biomass and waste

3D printing applications in modular construction

These innovations serve a dual purpose: improving cost-efficiency and reducing environmental impact, thereby enhancing long-term profitability and brand positioning.

Market Segmentation: Where Demand Lies

The industry’s segmentation reveals deeper insights into demand patterns:

By Type: Portland cement dominates with a 47.5% share, valued for its strength and reliability in varied construction environments.

By End Use: Residential construction remains the dominant application, accounting for over 60% of demand. This reflects the housing boom in urban centers and tier-2 cities globally. The rest comes from infrastructure (bridges, roads) and commercial developments.

Major Players: Consolidation and Global Reach

The cement market is moderately consolidated, with global players leveraging vertical integration and regional presence:

China National Building Materials (CNBM) leads the pack with production scale and domestic dominance.

Holcim Ltd focuses on innovation and sustainability leadership across continents.

Anhui Conch Cement strengthens China’s global exports and local penetration.

Heidelberg Materials brings European expertise to emerging markets with a focus on energy-efficient solutions.

These firms are reshaping their portfolios to align with green building norms and expanding through mergers, acquisitions, and technology collaborations.

The Road Ahead: Forecasting the Industry’s Path

The next decade offers a mixed outlook:

India and Southeast Asia are poised for robust double-digit growth, driven by government-backed infrastructure investments and public housing programs.

China, on the other hand, faces a real estate sector slowdown, requiring strategic pivots toward exports and innovation.

Western markets may stabilize with modest growth, increasingly focused on retrofitting and sustainable urban renewal.

Despite regional divergences, sustainability and digitization will universally define competitiveness in the industry.

Cementing a Smarter, Greener Future

The cement industry in 2025 is not merely about capacity expansion—it’s about smart growth. As the global economy rebuilds in the post-pandemic landscape and grapples with climate commitments, the industry must reimagine itself. Decarbonization, innovation, and regional agility will determine which firms lead the next construction boom. Cement may be an ancient material, but in today’s world, it is rapidly becoming a futuristic one—foundational not only to buildings, but to sustainable development.

Leave a comment