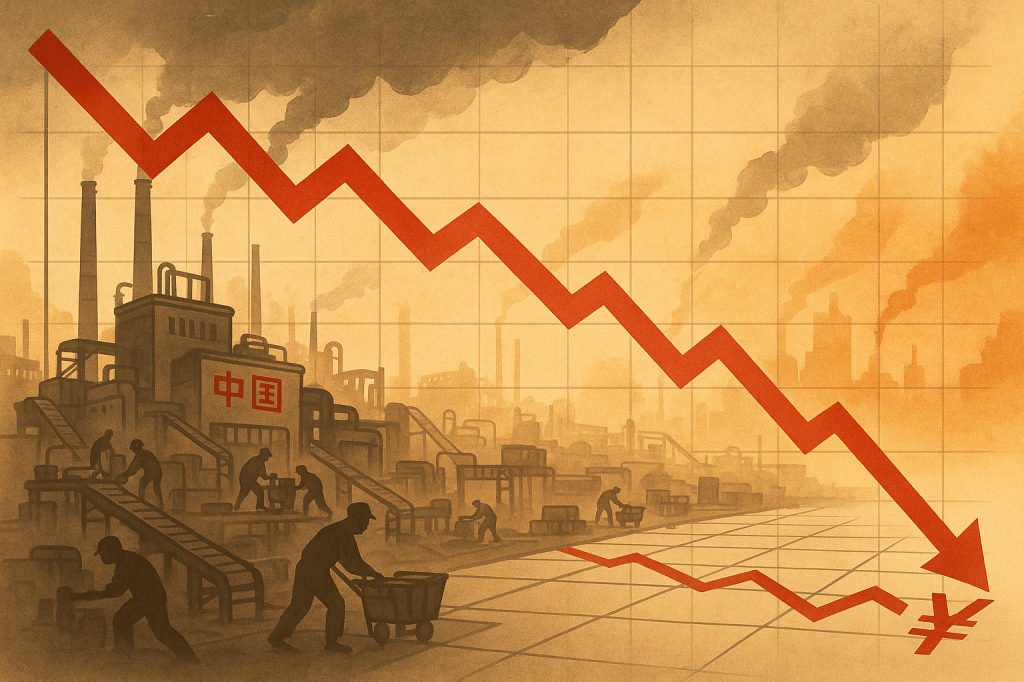

As much of the world continues to struggle with high inflation—from the United States to Europe and most emerging markets—China stands out as a rare case moving in the opposite direction. Prices in China have remained unusually low, and in many sectors, they continue to fall. This deflationary trend is not simply a temporary demand slowdown. It is rooted in a deeper structural phenomenon shaping the Chinese economy: “involution.”

This dynamic has turned China into a hyper-competitive, low-price economy even as other countries are forced to manage the cost-of-living crises. Understanding how China arrived here—and what this means for its economic future—requires a closer look at the forces driving its price war culture and the unique risks it now faces.

The Rise of “Involution”: China’s Race to the Bottom

“Involution” (nei-juan) is a Chinese term that originally described excessive effort in schooling and work competition. Today it has become a powerful economic metaphor:

too many firms competing for too little profit, pushing prices endlessly lower.

Unlike normal competition, which rewards efficiency and innovation, involution traps industries in a loop of:

constant price-cutting, often selling below cost;

overcapacity, where producers continue manufacturing even without demand;

collapsing margins, leaving little room for R&D;

strategic stagnation, as innovation becomes unaffordable.

This pattern is highly visible in sectors where China once celebrated its global leadership:

1. Electric Vehicles (EVs)

More than 150 companies have been caught in a price war, with some models selling at near zero profit.

2. Solar Panels and Batteries

Excess capacity has crushed prices, benefiting global buyers but eroding domestic profitability.

3. E-commerce

Platforms compete by driving prices down to unsustainable levels, squeezing sellers and logistics providers.

These industries are symbols of China’s industrial strength—but also the sectors most vulnerable to involution.

Why China Has Low Prices When the World Has Inflation

While global inflation remains elevated—averaging nearly 5.5% in emerging markets—China’s consumer inflation barely reached 0.2% in October 2025 after months of deflation. Producer prices have fallen for almost three consecutive years, a historic stretch even for China.

The underlying causes include:

1. Weak Domestic Demand

Consumers are cautious due to slow income growth, high savings motives, and pessimism about the property market.

2. Massive Industrial Overcapacity

Years of state-led investment have created more factories than domestic or global markets can absorb.

3. Extreme Price Competition

With too many players chasing too few buyers, firms slash prices simply to survive.

4. Policy Focus on Supply, Not Consumption

China’s development model has historically centred on production and exports, leaving household consumption structurally weak.

Thus, China’s low-price environment isn’t a result of efficiency alone—it is also a symptom of imbalance.

From Reform-Era Boom to Today’s Deflation Trap

China’s transition from a high-growth miracle to a low-inflation, low-demand economy is rooted in its last four decades of development.

1980s–2000s: The Export-Driven Era

China built its growth on cheap labour, abundant land, large-scale manufacturing, and global demand. Prices were kept low deliberately to dominate global markets.

2008–2015: The Investment Surge

Post–global financial crisis, China used massive stimulus to boost investment. This expanded industrial capacity far more rapidly than consumption.

2016–2025: Tech Boom Meets Overcapacity

Sectors like EVs, solar, batteries, and electronics scaled rapidly—but with little demand-side support. As supply rose faster than demand, price wars began.

Involution is therefore not sudden—it’s the accumulated effect of decades of investment-heavy industrial policy.

Policy Response: Can China Escape the Involution Cycle?

Beijing recognises the risks and is experimenting with several measures to slow the downward spiral:

1. Updating pricing laws

Regulations now discourage companies from selling below cost.

2. Production capacity reduction

Industries with severe oversupply—especially EVs and solar—are being asked to consolidate.

3. Boosting domestic consumption

China is trying to shift from export-led to consumption-driven growth, but income and confidence remain weak.

4. Moral suasion

Authorities are pressuring firms to avoid destructive price wars.

However, these moves face structural barriers. Consumers remain uncertain, private investment is slow, and demographic pressures are intensifying. For now, China’s low-price equilibrium persists.

A Deflationary Giant in an Inflationary World

The contrast between China and the global economy is striking:

Globally: indebted governments, supply shocks, geopolitical tensions, and higher wages continue pushing inflation upward.

In China: excess supply, weak consumption, and involution push prices down.

This creates several long-term risks:

1. Profit Erosion → Investment Slowdown

If firms cannot maintain margins, R&D and innovation suffer.

2. Wage Suppression → Demand Weakens Further

Low corporate profitability limits wage growth, creating a feedback loop.

3. Rising Global Tensions

Western economies accuse China of exporting deflation and flooding markets with underpriced goods.

4. Domestic Structural Reforms Needed

China must rebalance toward consumption, reduce excess capacity, and support high-quality innovation—ambitions that may take years.

Final Assessment

China is entering a prolonged phase of low inflation, low margins, and high competition, driven by involution and excess supply. In a world worried about rising prices, China faces the opposite problem: prices that are too low for its own economic health.

The next decade will likely be shaped by how effectively China can move away from quantity-driven growth and build a more innovation-driven, consumption-oriented economy. This transition will influence not only China’s trajectory but also global manufacturing, trade, and geopolitical tensions. #ChinaEconomy

#Involution

#DeflationPressure

#PriceWar

#Overcapacity

#LowInflation

#WeakDemand

#IndustrialCompetition

#EconomicRebalancing

#GlobalTradeImpact

Leave a comment