Russia’s energy export story in August 2025 offers a telling snapshot of the shifting global energy landscape. For the third consecutive month, the country’s fossil fuel export revenues have contracted, slipping another 2% month-on-month to €564 million per day. This decline underscores not only the vulnerabilities in Russia’s heavy reliance on oil revenues but also the ways in which alternative energy markets and regional dynamics are reshaping the flow of trade.

Crude Oil: The Hardest Hit Sector

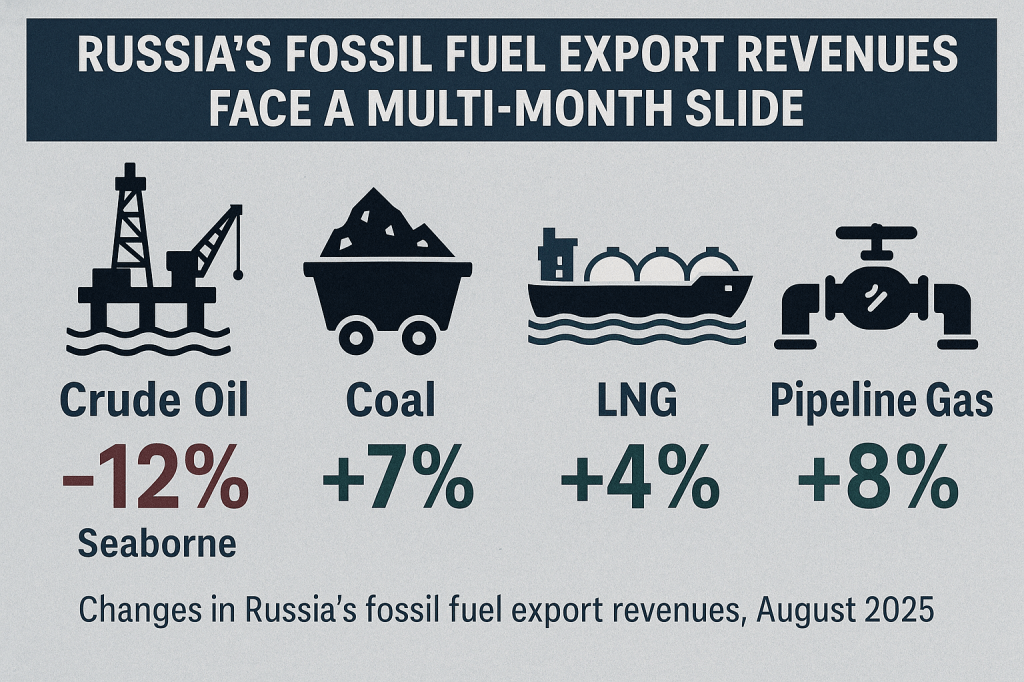

The most striking fall occurred in seaborne crude oil exports, where revenues tumbled by 12% and export volumes dropped by 10% compared to July. This sharp contraction reflects two converging pressures: weaker global crude demand and constrained access to major Western markets due to ongoing sanctions. Moreover, price fluctuations in global oil benchmarks have left Russia with thinner margins, further eroding the stability of its oil-driven revenue base.

This sustained weakness in oil is particularly concerning, as crude has historically accounted for the lion’s share of Russia’s energy earnings. The August decline signals deeper structural challenges that cannot be offset by marginal gains elsewhere.

Coal: A Bright Spot Driven by South Korea

In sharp contrast, coal exports surged by 7%, hitting their highest revenue level of 2025. The key driver behind this spike has been robust demand from South Korea, which has leaned on Russian coal supplies to meet domestic power requirements amid rising energy costs in Asia.

Coal’s resilience highlights two critical points: first, Russia’s ability to pivot toward non-Western buyers, and second, the continuing appetite for coal in parts of Asia despite global decarbonization commitments. However, coal’s contribution remains smaller in absolute terms compared to oil, limiting its ability to offset the wider revenue shortfall.

Gas: Modest but Steady Gains

Natural gas provided a modest cushion to the declining oil revenues. LNG exports rose 4%, while pipeline gas revenues increased by 8%. These gains illustrate how Russia has restructured parts of its gas trade to tap into more flexible and regionally diverse markets. LNG, in particular, offers Russia a way to circumvent traditional pipeline dependencies, reaching buyers in Asia and the Middle East.

Still, while gas revenues are moving upward, they remain a smaller slice of Russia’s export pie. Their growth is significant in terms of diversification, but insufficient to fully stabilize the country’s energy income.

Drivers Behind the Decline

The August 2025 numbers point to three interconnected drivers behind Russia’s faltering fossil fuel earnings:

1. Sanctions and Market Diversion – Western sanctions continue to block Russia’s access to traditional high-value buyers, forcing a pivot to Asian and other emerging markets, often at discounted prices.

2. Volatile Global Demand – Global oil demand has softened amid slowing economic growth in advanced economies, further pressuring Russian export earnings.

3. Energy Transition Pressures – The long-term global pivot toward renewables and alternative energy sources has reduced Russia’s leverage as a dominant fossil fuel supplier.

Implications for Russia’s Economy

The sustained decline in export revenues poses critical challenges for Russia:

Fiscal Strain: Energy revenues remain central to Russia’s state budget, and a prolonged downturn risks widening deficits.

Geopolitical Leverage: Lower energy revenues reduce Russia’s ability to wield fossil fuels as a strategic bargaining chip in global politics.

Diversification Imperative: The relative strength of coal and gas highlights opportunities, but long-term sustainability requires a broader economic pivot.

Russia’s reliance on fossil fuel exports is being tested by structural shifts in global energy markets, leaving policymakers with the urgent task of balancing short-term revenue stability against longer-term strategic adjustments.

A Mixed Energy Landscape

The August data paints a mixed picture. Oil remains under severe pressure, coal has briefly surged thanks to South Korean demand, and gas revenues are inching upward. Together, these trends underscore a broader reality: Russia’s fossil fuel export model is facing erosion from multiple sides—sanctions, demand shifts, and global decarbonization efforts.

For Russia, the road ahead lies in adapting its trade strategies, deepening ties with energy-hungry partners, and diversifying its economy. Without such moves, the recurring declines in export earnings may become the norm rather than the exception.#RussiaEnergyExports #CrudeOilDecline #CoalDemand #SouthKoreaEnergy #LNGGrowth #PipelineGas #GlobalEnergyShift #SanctionsImpact #FossilFuelRevenue #EnergyDiversification

Leave a comment